Emission Trading

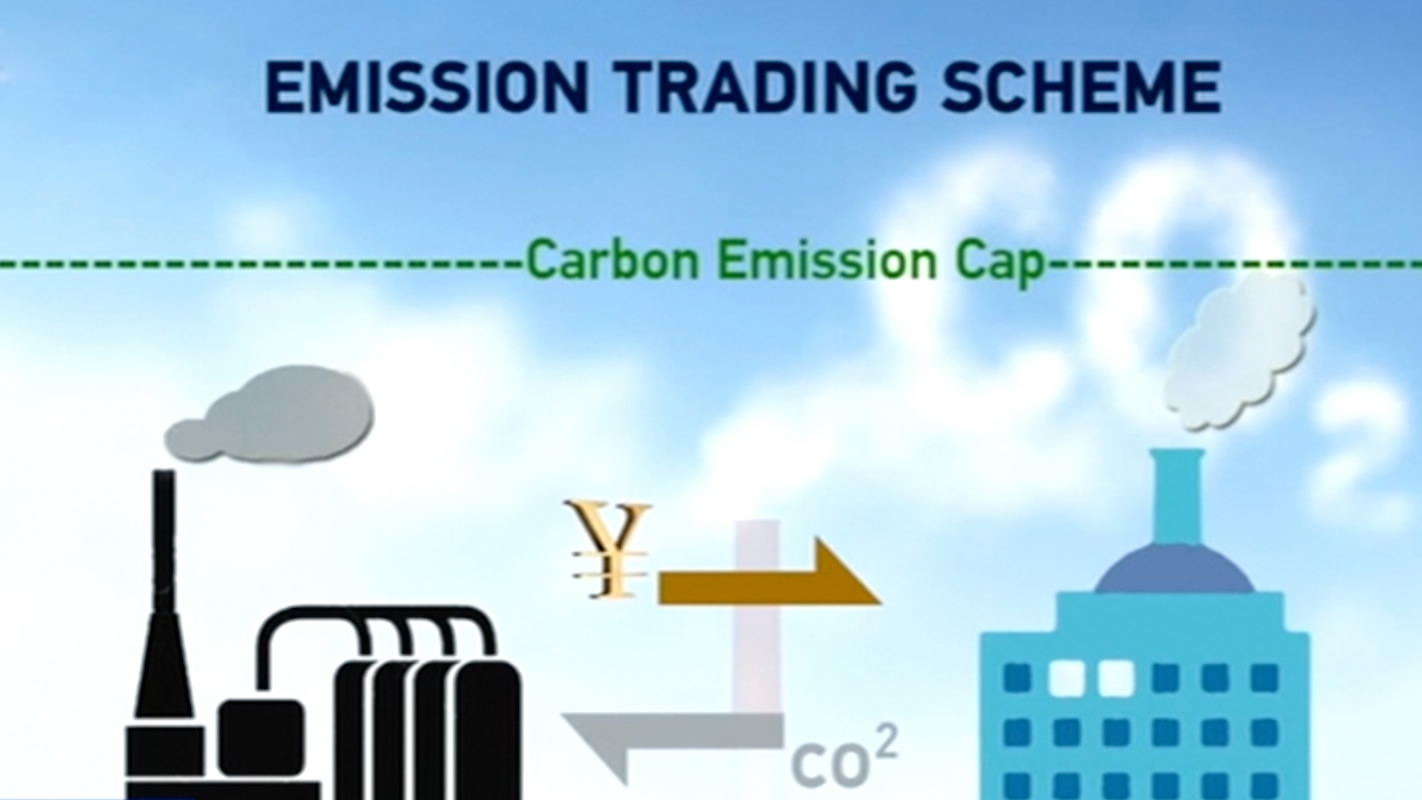

The market for carbon trading was $176 billion in 2011. Emissions trading, an environmental policy that seeks to reduce air pollution efficiently by putting a limit on emissions, giving polluters a certain number of allowances consistent with those limits, and then permitting the polluters to buy and sell the allowances.

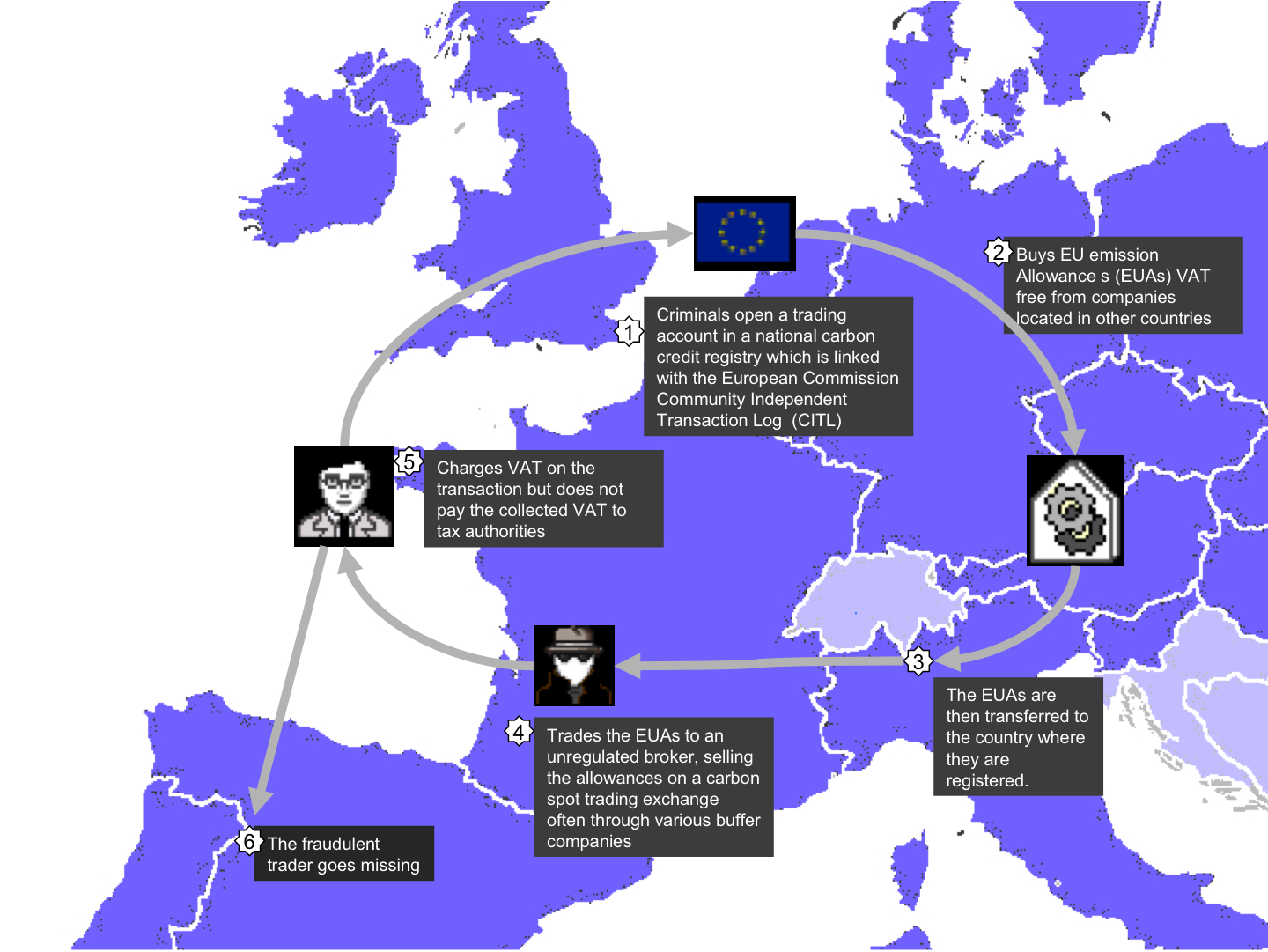

Further investigations into VAT fraud linked to the Carbon

Further investigations into VAT fraud linked to the Carbon

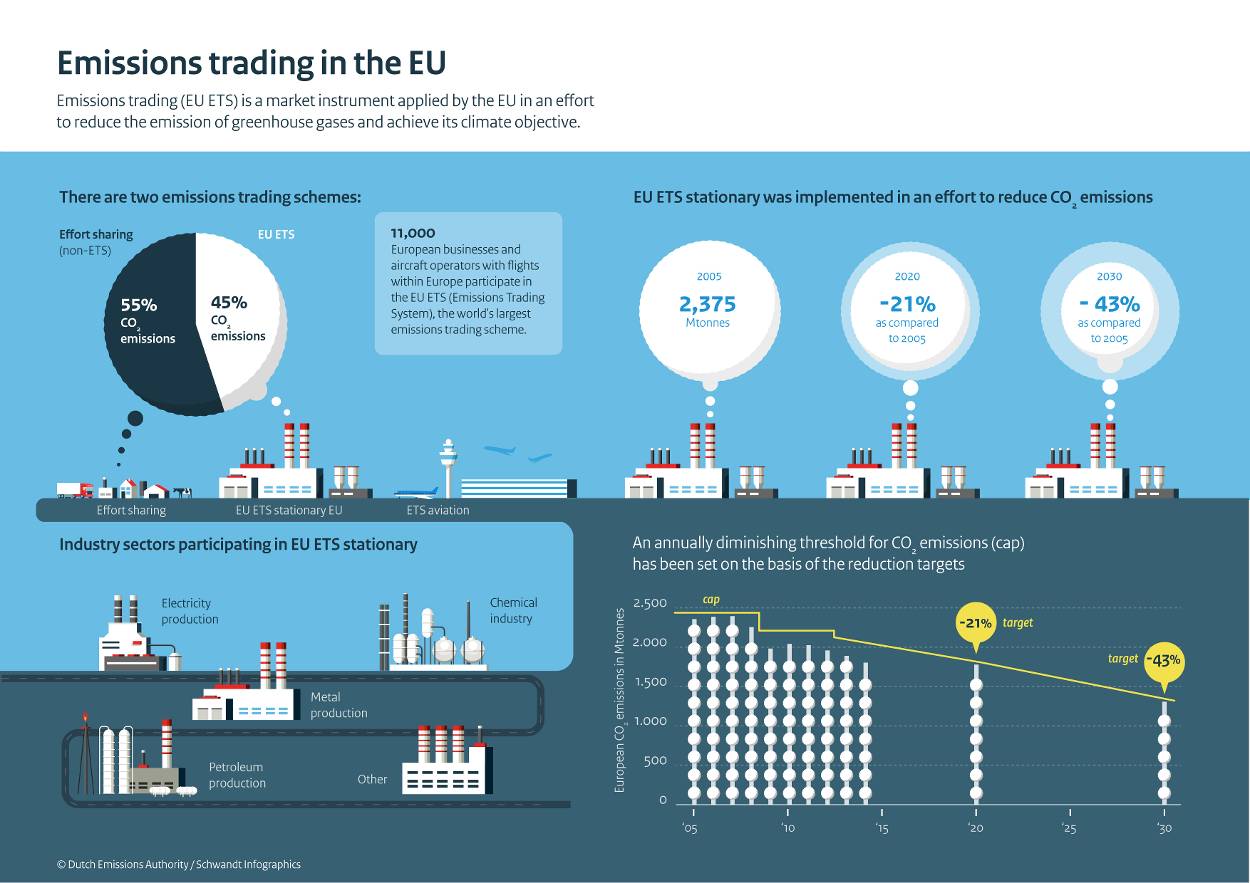

This is a central part of the european union’s policy of reducing greenhouse emissions from industrial sectors in a cost effective and an economically efficient way.

Emission trading. Emission trading system (ets) another important piece of legislation applicable to the textiles and clothing sector is the emission trading system (ets). With aviation now included in the european union emissions trading scheme (eu ets), aircraft operators flying to, from and within the eu have to surrender. At least 84% of this is the eu's emission trading scheme.

Under carbon trading, a country or a polluter having more emissions of carbon is able to purchase the right to emit more a Emissions trading, sometimes referred to as “cap and trade” or “allowance trading,” is an approach to reducing pollution that has been used successfully to protect human health and the environment. Cap and trade encourages operational excellence and provides an incentive and path for the deployment of new and existing technologies.

Emissions trading programs work by first setting an environmental goal: It could exceed $1 trillion by 2020. Thus, a new commodity was created in the form of emission reductions or removals.

However, significant further cuts in emissions remain necessary to achieve climate neutrality by 2050. The eutl is a central transaction log, run by the european commission, which checks and records all transactions taking place within the trading system. Emission trading programs generally can be accomplished by netting, offsets, bubbles, and banking.

Emissions trading programs have two key components: The eu ets data viewer provides an easy access to emission trading data contained in the european union transaction log (eutl). Namely the reduction of carbon emissions in an attempt to reduce future climate change.

The eu ets data viewer provides aggregated data by country, by main activity type and by year on the verified. This environmental goal is a critical part of an emissions trading program. It caps emissions for any company doing business in the eu.

The emissions trading system will reward more efficient and lower carbon power stations, as they will need to make fewer emissions reductions to comply and could profit from trading. The “tradable performance standard” benchmark approach sets emissions targets relative to output. The manufacturing, agriculture, transport, waste, power generation and other sectors release the gas that traps heat from the sun and thus contributes to global warming.

This consultation looks for stakeholder input on the revision of the eu emissions trading directive, including on the role of the eu ets and its contribution to the overall climate ambition for 2030. The european union’s energy system is decarbonising rapidly. The first trading period successfully established the free trading of emission allowances across the eu, put in place the necessary infrastructure and developed a dynamic carbon market.

The trading of a finite number of allowances results in a market price being put on. An offset allows a major new source. Uncertainty in future supply and demand conditions (market volatility) coupled with a fixed number of pollution permits creates an uncertainty in the future price of pollution permits, and the.

Find out how we can help you to implement an effective carbon compliance strategy. Netting allows large new sources and major modifications of existing sources to be exempted from certain review procedures if existing emissions elsewhere in the same facility are reduced by a sufficient amount. To implement this plan, the commission is proposing to revise the key relevant energy and climate legislation by june 2021.

An emission cap and permit trading system is a quantity instrument because it fixes the overall emission level (quantity) and allows the price to vary. A limit (or cap) on pollution, and tradable allowances equal to the limit that authorize allowance. Key lessons and guiding questions for policy makers are provided to help with developing and implementing emission trading systems.

This form of permit trading is a common method countries utilize in order to meet their obligations specified by the kyoto protocol; The environmental benefit of the first phase may be limited due to excessive allocation of allowances in some member states and some sectors, due mainly to a. The eu emissions trading scheme is a key pillar of european climate policy.

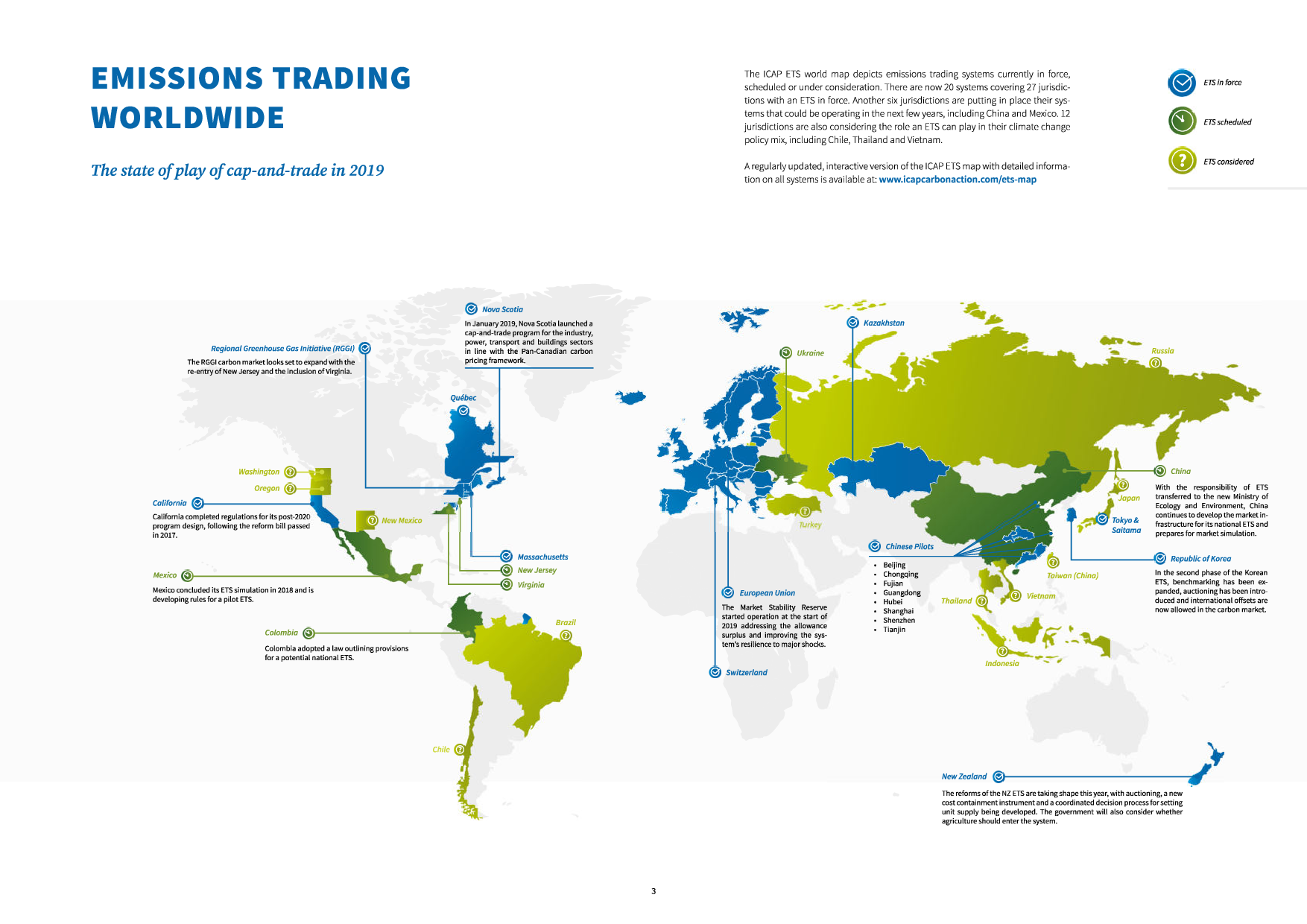

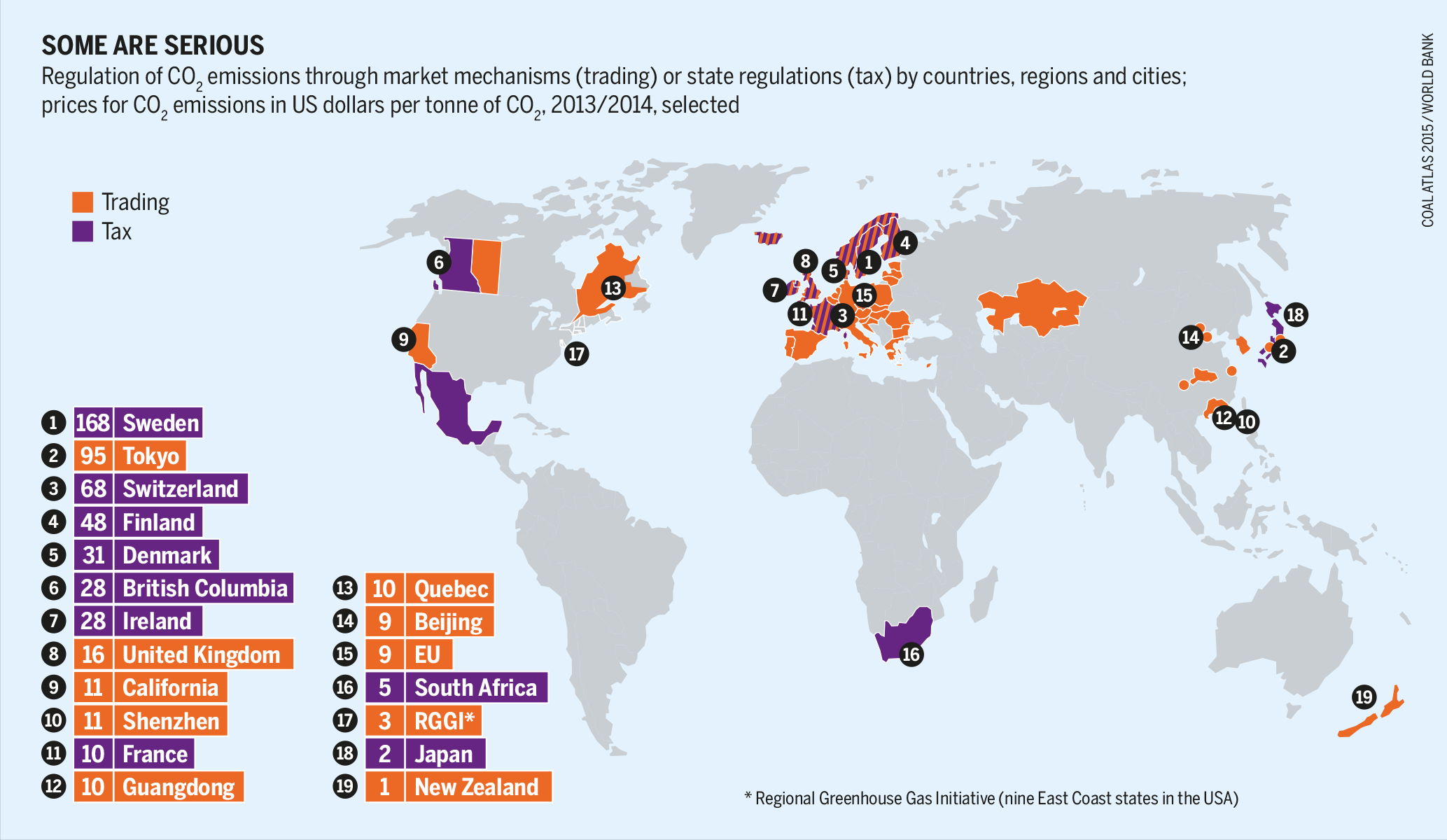

Carbon emissions trading is a form of emissions trading that specifically targets carbon dioxide and it currently constitutes the bulk of emissions trading. Carbon pricing initiatives are spreading throughout the world. In addition, common challenges in trading system design and implementation for the power and industry sectors are analysed.

A national, or sometimes regional, limit on the overall amount of pollution that sources are allowed to emit into the environment. An emission trading system (ets) is a powerful policy instrument for managing greenhouse gas (ghg) emissions. By creating tradable pollution permits it attempts to add the profit motive as an incentive for good performance, unlike.

In 2019, emissions from stationary installations covered by the eu emissions trading system (eu ets) declined by 9.1 %.

Infographics How does the EU ETS work? Publication

Infographics How does the EU ETS work? Publication

Emissions Trading Fighting climate change with the market

Emissions Trading Fighting climate change with the market

China launches nationwide carbon emission trading scheme

China launches nationwide carbon emission trading scheme

Emissions Trading Scheme Overview 2010 Interpine

Emissions Trading Scheme Overview 2010 Interpine

“Marketbased” approaches to regulating emissions capand

“Marketbased” approaches to regulating emissions capand

International Carbon Action Partnership (ICAP) STATUS

International Carbon Action Partnership (ICAP) STATUS

POLICY COMPASS for a sustainable future The State of

POLICY COMPASS for a sustainable future The State of

The Global Rise of Emissions Trading Climate Policy Info Hub

Reducing emissions or/and promoting renewables? A glance

Reducing emissions or/and promoting renewables? A glance

Emissions trading Strong players, feeble instruments

Emissions trading Strong players, feeble instruments

Can carbon trading cut EU emissions to net zero

Can carbon trading cut EU emissions to net zero

NewEnergyNews WORLD EMISSIONS TRADING PLANS

NewEnergyNews WORLD EMISSIONS TRADING PLANS

GHG emissions Responsible LOTOS.pl

Q&A Will the reformed EU Emissions Trading System raise

Q&A Will the reformed EU Emissions Trading System raise

The Global Rise of Emissions Trading Climate Policy Info Hub

10 practical steps to create an Emissions Trading System

Current and proposed emissions trading schemes Visual.ly

Current and proposed emissions trading schemes Visual.ly

Australian Emission Trading System Ten years of

No comments: