Divergence Trading

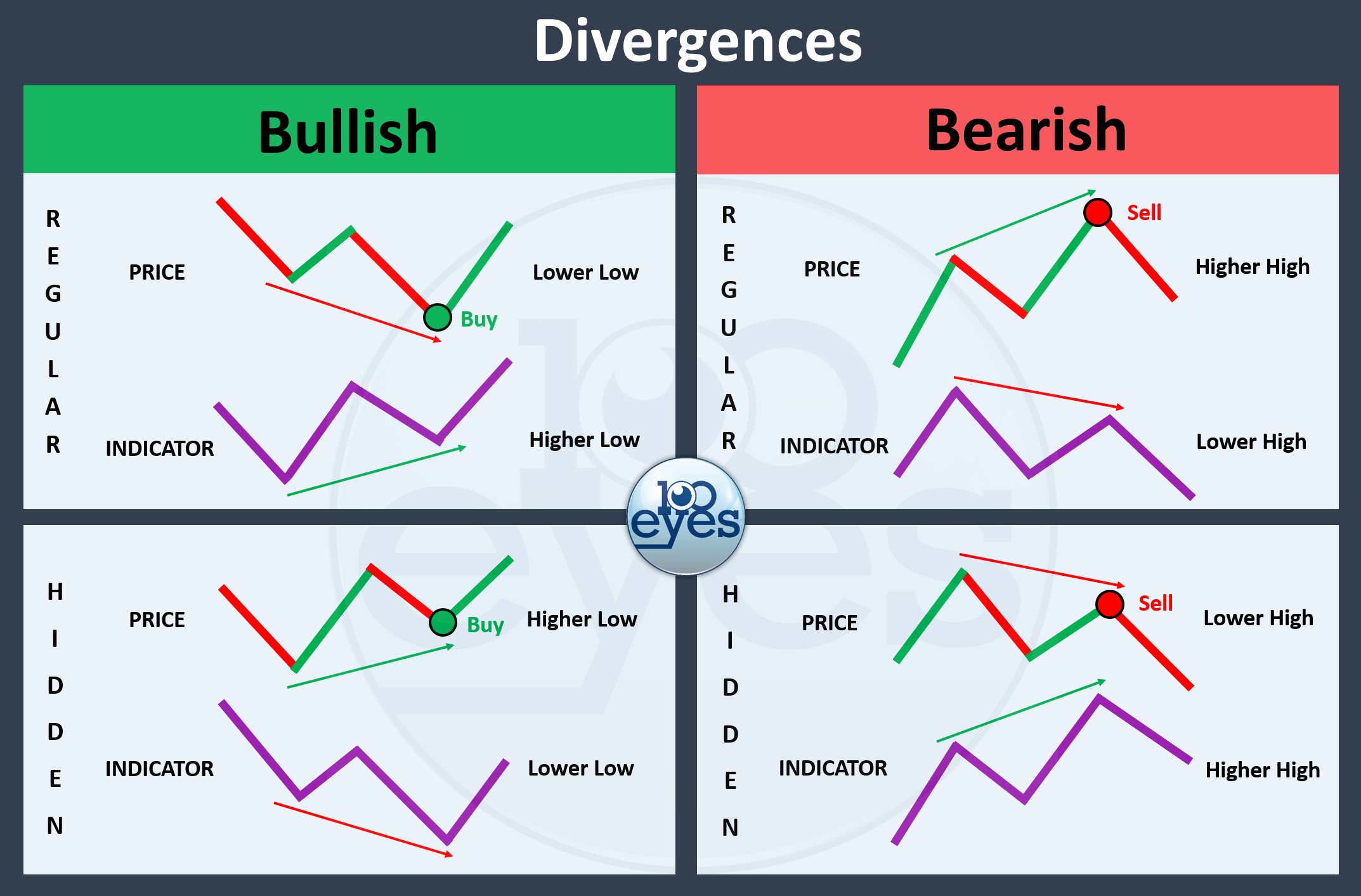

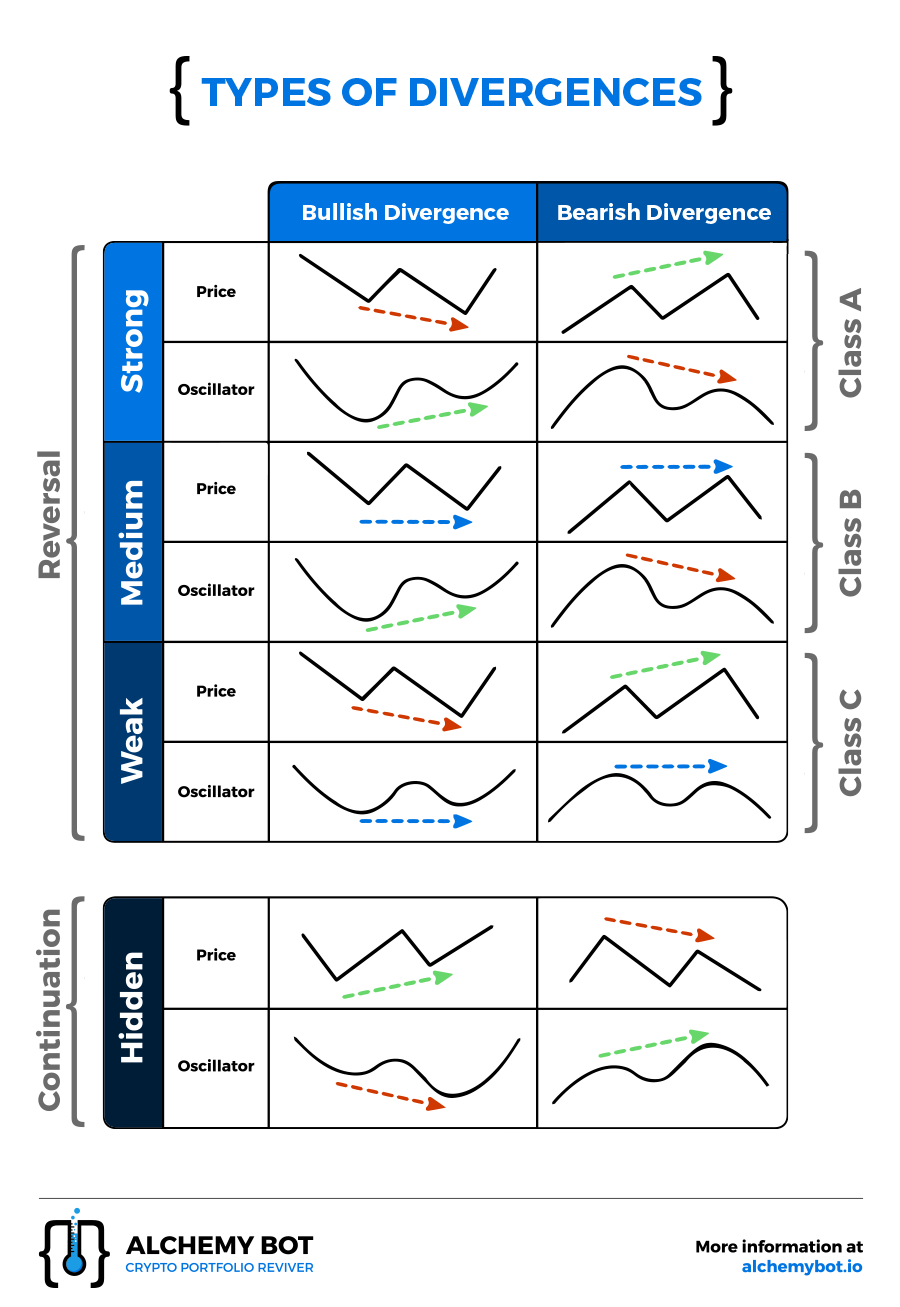

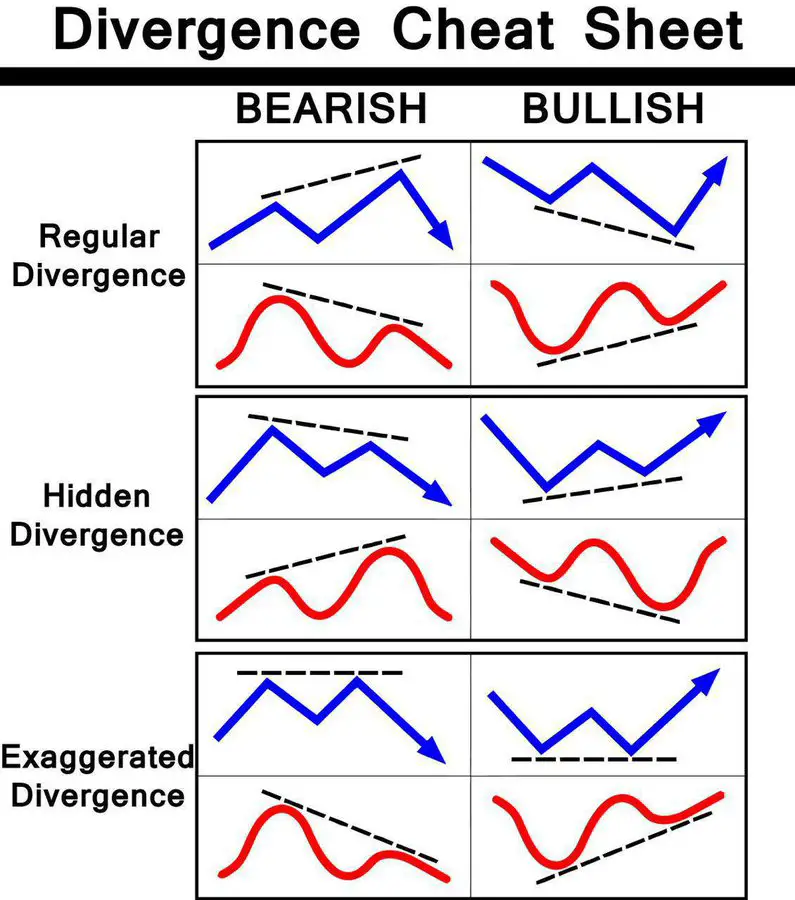

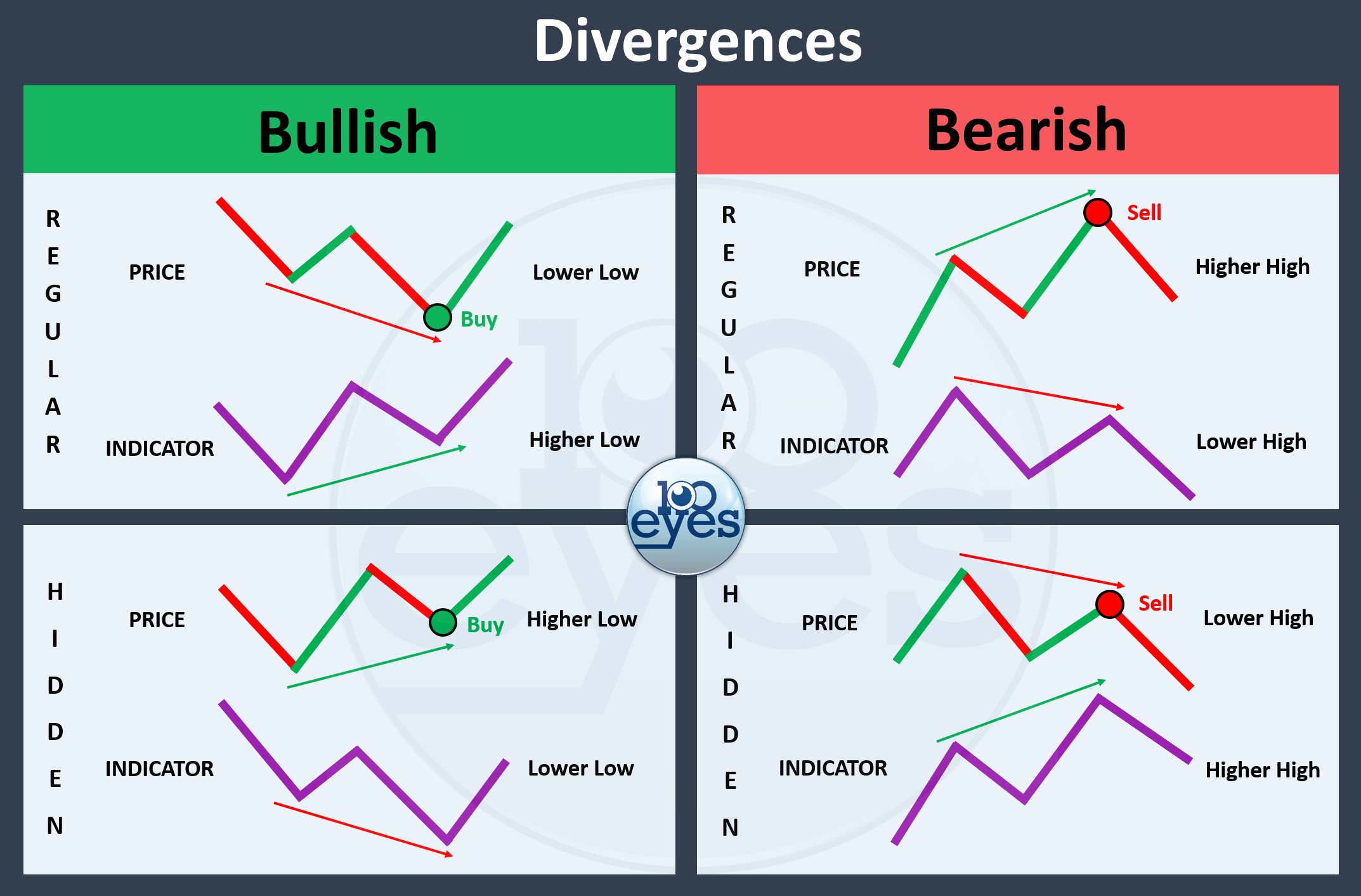

Here we talk about the stochastic divergence best divergence trading. Divergence is when the price movement of a currency is in the opposite direction of the movement of a technical indicator.

RSI Hidden Divergence Pullback Trading Guide Trading

RSI Hidden Divergence Pullback Trading Guide Trading

And as can be observed, a trade with divergence on the bearish bias did have.

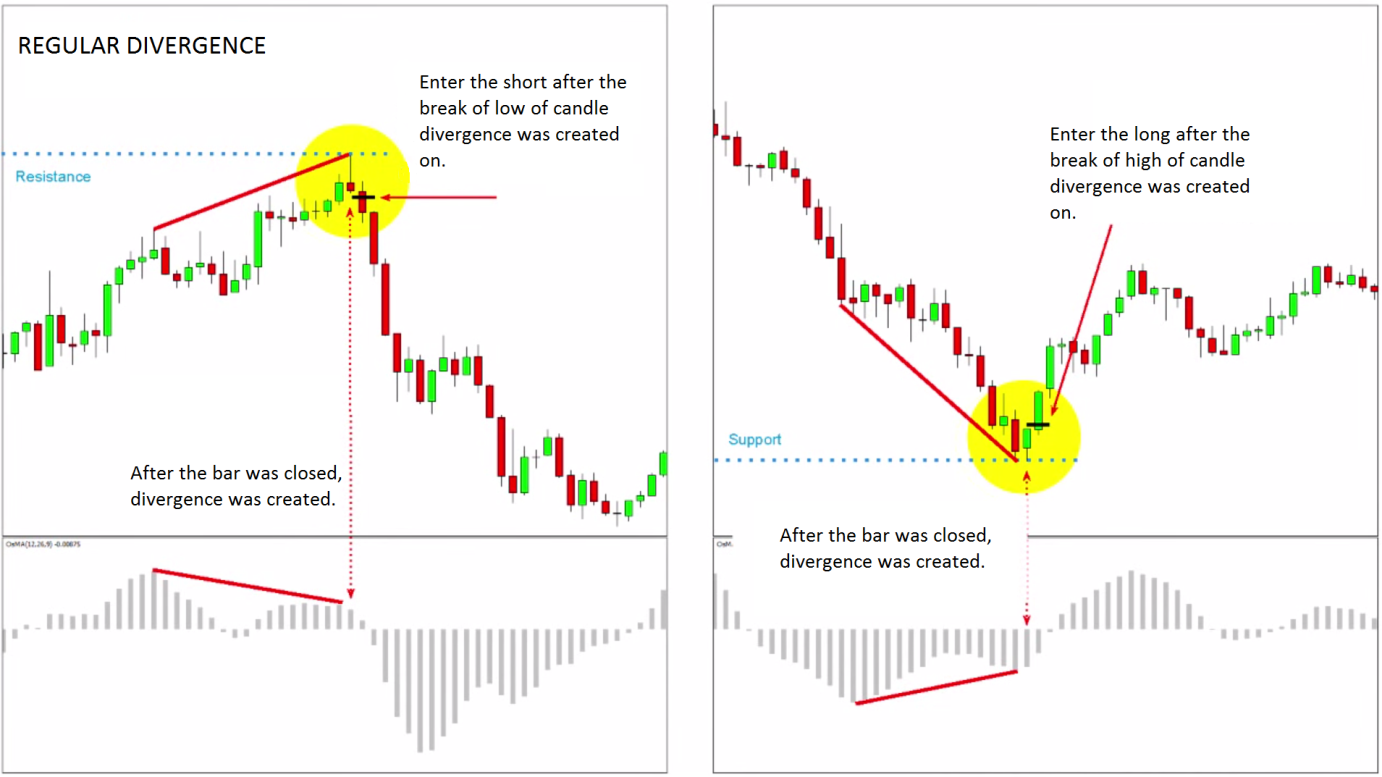

Divergence trading. Divergence trading from the wrong side of price. Click here to get a pdf of this post. A divergence occurs when an oscillator’s local tops/bottoms do not match local tops/bottoms of price.

What if you were already in a long position and you could know ahead of time the perfect place to exit instead of watching all your unrealized gains vanish before your eyes because your trade reverses direction? Divergence theory with this regular divergence pattern indicates a high probability of price reversing to the downside. Menggunakan teknik divergence dalam belajar forex gold dapat berguna untuk menemukan melemahnya suatu trend atau signal kelanjutan trend.dengan kata lain divergence trading forex gold di time frame (tf) berapapun dan dengan gaya/tipe trading.

A bearish divergence consists of an overbought rsi reading, followed by lower high on rsi. Sometimes you can even use it as a signal for a trend to continue! Both are used during different periods of time during trading.

It is an age old concept that was developed by charles dow and mentioned in his dow tenets. Just like any trading strategy, you need to add more confluence factors to make your strategy strong. Home divergence trading divergence cheat sheet.

Forex divergence trading is both a concept and a trading strategy that is found in almost all markets. Pada dasarnya, divergence trading adalah trading menggunakan patokan perbedaan antara pergerakan harga dengan pergerakan indikator oscillator. Just a single divergence is not a strong enough signal and i typically recommend building confluence (other signals) around divergence systems.

Using divergence trading can be useful in spotting a weakening trend or reversal in momentum. The main advantage of this system is the fact that we have 2 market forces on our side when trading: A divergence in an uptrend happens when price action makes a new higher high but the technical indicator used on the chart doesn’t.

What is divergence in forex trading? Divergence is a very useful tool to help traders spot trend reversals or continuation patterns. Today, in this article we would discuss about the divergence trading strategies …

Trend trading is a style of trading that attempts to capture gains when the price of an asset is moving in a sustained direction called a trend. Hopefully, you can now see why trading divergence can be a helpful technique with adjusting your position sizing, reducing risk, and identifying clear trading opportunities. Di artikel sebelumnya, sekilas kita sudah menyinggung masalah divergence trading.

Indeed, it can help you stay on the right side of price action on many time frames, small and large. In my indicator strategy course, we included a few divergence systems as well. Divergence trading is an awesome tool to have in your toolbox because divergences signal to you that something fishy is going on and that you should pay closer attention.

Rsi divergence occurs when the relative strength index indicator starts reversing before price does. Rsi divergence divergence macd divergence. Apa sih sebenernya divergence trading?

The applied divergence strategy has the best performance on long time frames such as daily, weekly, and monthly charts. With the help of divergence, you will be able to determine the trend will continue or reverse. In general, if the price is rising and making higher highs but the indicator is making lower lows, there’s a divergence.

Nah, kali ini mari kita bahas lebih detil tentang divergence trading ini. But how does it work and when does it stop working? The difference between divergence and confirmation is that divergence tells the trader when the stock price and technical indicator are providing opposite signals, while confirmation is when the indicator and asset price are displaying the same signals.

Divergence dalam trading forex gold, options, saham, dll adalah pola yang perlu diketahui karena dapat memberikan informasi potensi arah trend yang kuat. Biasanya kita bisa menemukan divergen bullish saat pasar bergerak dekat level rendah, sedangkan divergen bearish bisa ditemukan saat pasar bergerak dekat level. Price action has a different important in forex trading market, this market has a great usage of trend system and in it divergence day trading plays a great role.

By using this approach, we’ll reduce the market noise and eliminate false signals. Divergence trading what if there was a low risk way to sell near the top or buy near the bottom of a trend? If we try to understand in lam and terms so divergence is a complete trading system.

The same 50 level divergence principle can be applied on divergence day trading strategy, hourly chart, or daily chart. Divergences are used by traders in an attempt to determine if a trend is getting weaker, which may lead to a trend reversal or continuation. Before you head out there and start looking for potential divergences, here are nine cool rules for trading divergences.

Using divergence is a popular way to identify potential trading opportunities. What is a divergence in trading? Dow noticed that when the dow jones industrials made new highs, the dow transportation index tends to make new highs as well and when the industrials index made new lows, the transportation index would.

It is a warning sign that the current price trend may be weakening. Divergences are considered powerful and reliable entry triggers, both for reversals and continuations. Positive divergence is a analysis tool that constructs profitability trade which protects from loss.

Divergence, one of the key indicators in the technical analysis of currency trends, will be the focus of this article. In this guide, we’re going to cover everything you need to know about divergence, including what it is, the different types. Forex divergence trading indicators or trading strategies are one of the most famous indicators 9or strategies in the forex markets.the cause behind this popularity is that divergences are the most significant indicator and may lead up to whichever turns in the price movement.

A divergence alone is not something that strong enough and many traders experience bad results when trading only with divergences. The bullish divergence rising trend started around 50 levels. A divergence occurs when an asset’s price is moving in one direction and an indicator is moving in a different direction.

In technical language, we can say stochastic divergence is a high probability of price retracement. Being able to spot these types of patterns is a massive advantage as they will help you to identify new trading opportunities and give you an idea of future price action.

MACD Hidden Divergence Trading Strategy Trading Setups

Sharpshorts Day Trading .....2a...DIVERGENCES

Sharpshorts Day Trading .....2a...DIVERGENCES

Comment trader la Divergence RSI Guide Complet 2019

Comment trader la Divergence RSI Guide Complet 2019

FX5 Divergence Trading System Forex Strategies Forex

FX5 Divergence Trading System Forex Strategies Forex

Understanding Divergences for Crypto Trading by Alchemy

Understanding Divergences for Crypto Trading by Alchemy

Comment trader la Divergence RSI Guide Complet 2019

Comment trader la Divergence RSI Guide Complet 2019

Types of Divergence for POLONIEXETHBTC by Yrat — TradingView

Types of Divergence for POLONIEXETHBTC by Yrat — TradingView

A Divergence Trading STRATEGY (That Actually Works

A Divergence Trading STRATEGY (That Actually Works

Forex Safe Zone Strategy Pdf Forex Ea Writer

Forex Safe Zone Strategy Pdf Forex Ea Writer

Divergence HowTo Day Trade the Setup with Three Popular

Market stalker S&R trading My Trading 3 May 2015

Market stalker S&R trading My Trading 3 May 2015

2. Hidden Divergence Learn FX Trading Now

2. Hidden Divergence Learn FX Trading Now

Forex Price Action with CCI Divergence Strategy YouTube

Forex Price Action with CCI Divergence Strategy YouTube

MustKnow Facts About Divergence In Trading Winners Edge

MustKnow Facts About Divergence In Trading Winners Edge

Divergence types on the market 📌 SuperForex Forex

Divergence types on the market 📌 SuperForex Forex

RSI Divergence Master The Trade Live Trade Example

RSI Divergence Master The Trade Live Trade Example

Divergence Cheat Sheet New Trader U

Divergence Cheat Sheet New Trader U

Forex Divergence Trading Forex Lion System

Forex Divergence Trading Forex Lion System

Divergence Trading 100eyes Scanner

Divergence Trading 100eyes Scanner

No comments: