Macd In Trading

It represents the distance between the macd line and the signal line. It is used as a trend direction indicator as well as a measure of the momentum in the market.

How to use MACD Indicator to Trade Stock & Binary Options

Users of the macd generally avoid trading in this situation or close positions to reduce volatility within the portfolio.

Macd in trading. The second is the number of periods that are used in the slower moving average. The final part of the indicator is the moving average convergence divergence histogram. Mempelajari trading untuk momentum jangka pendek termasuk salah satu kegiatan yang sulit.

It calculates the difference of two exponential moving averages; It is calculated using moving averages, which makes it a lagging indicator. Dalam artikel ini finansialku akan membahas indikator yang cukup populer di kalangan trader analis teknikal, yaitu moving average.

This technical analysis guide explains what the moving average convergence divergence indicator (macd) is, and how traders use it to exercise trading strategies. Crossovers, divergences, and rapid rises/falls. Besides, macd is no longer useful after a strong price rally.

This video is not about the macd strategy. The most important signal of the moving average convergence divergence is when the trigger line crosses the macd up or down. Trading dengan menggunakan indikator macd (moving average convergence divergence).

How to trade with macd. Macd is an abbreviation for moving average convergence divergence. After all, a top priority in trading is being able to find a trend, because that is where the most money is made.

Instead, to use it with other indicators. How accurate is macd divergence? The price was moving in a narrow range, with the red lines representing the support and resistance level.

The macd is an extremely popular indicator used in technical analysis. This is because macd divergence when on its own, doesn't signal a reversal in price with the precision required for day trading. Moving average convergence divergence (macd) trading is a lagging technical analysis indicator used to spot reversals.

Setup for a classic macd strategy with some filter to choose. Trading divergence is a popular way to use the macd histogram (which we explain below), but unfortunately, the divergence trade is not very accurate, as it fails more than it succeeds. Traders will also use it to confirm a trade when combined with other strategies as well as a means to enter a trading.

A full macd indicator, as shown in this figure, includes […] We explore what the macd indicator looks like on an example chart and how you can read it to gain trading insight. In this video, you will learn, how macd can improve your existing trading strategy, by giving you some really useful information.

This gives us a signal that a trend might be emerging in the direction of the cross. Well, when it comes to the macd trading strategy we don’t need such a significant crossing to generate valid trade signals. It place the stop loss and take profit based on the trading rush video of macd, if you want a different profict factor you can change until to reach 3, over this as a fixed risk reward don't have so much sense

Divergence between the macd and the price action is a stronger signal when it confirms the crossover signals. Macd indicators can be interpreted in commonly three methods: Most notably these aspects are momentum, as well as trend direction and duration.

It keep the default setup of macd because is the most popular. It is also important that the macd is a popular basis for developing your own indicators (example: At one point, the price tried to break above the resistance but failed to hold above it effectively.

It is designed to measure the characteristics of a trend. The macd is part of the oscillator family of technical indicators. Last updated on january 12th, 2021.

Its purpose it to help generate trading signals by identifying when there’s a turning point in the trend. I have already made a video on the best macd strategy, but in that video, i never talk about why macd is one of the most useful indicator out there. A trend following strategy is popular amongst both new and experienced traders.

The macd ( moving average convergence divergence ) indicator is a technical analysis tool that was designed by gerald appel in the late 1970s. As shown on the following chart, when the macd falls. Just like any other trading indicator, it is best not to use macd in isolation.

The moving average convergence divergence (macd) is a technical indicator used to identify new trends or momentum and show the connection between the price of two moving averages. Majority of traders have entered a trade at the end of a trend only to see. The main function of the macd is to discover new trends and to help find the end of present trends.

If the macd line is above the signal line, the histogram is positive, and vice. It can be used to identify aspects of a security's overall trend. Akan tetapi lebih sulit lagi ketika seseorang tidak menggunakan alat indikator yang layak.

The macd indicator is one of the most widely used indicators for forex trading. The result of that calculation is the macd line. During trading ranges the macd will whipsaw, with the fast line crossing back and forth across the signal line.

Moving average convergence divergence (macd) is one of the most commonly used techincal analysis indicators. Macd strategy to identify tired trends. With a macd chart, you will usually see three numbers that are used for its settings.

The 12 and 26 ema's.

How to use MACD Indicator to Trade Stock & Binary Options

How Do You Trade The MACD Indicator?

How Do You Trade The MACD Indicator?

MACD Trading Secrets Trading Places with Tom Bowley

MACD Trading Secrets Trading Places with Tom Bowley

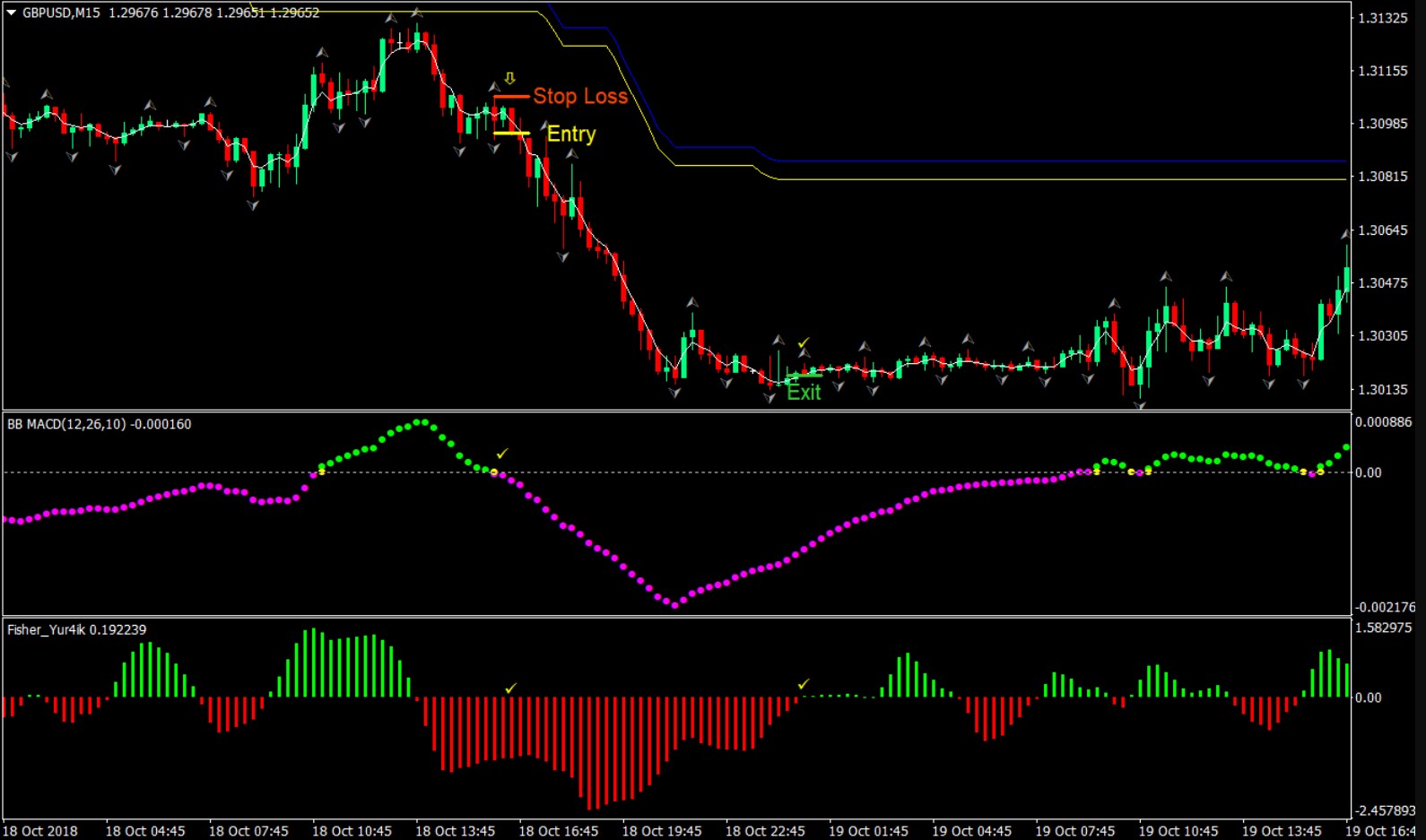

MACD Crossover Forex Trading Strategymacd histogram

MACD Crossover Forex Trading Strategymacd histogram

How to Use the MACD Indicator when Trading IG EN

How to Use the MACD Indicator when Trading IG EN

Fratelli MACD Forex Trading Strategy Free Download

Fratelli MACD Forex Trading Strategy Free Download

Learn Forex Three Simple Strategies for Trading MACD

Learn Forex Three Simple Strategies for Trading MACD

MACD with ADX Trading System definition YouTube

MACD with ADX Trading System definition YouTube

What is the full form of MACD in trading? Quora

MACD Complete Guide on How to Use MACD in Trading

MACD Complete Guide on How to Use MACD in Trading

MACD Swing Trading Strategy MACD Trading Example

MACD Swing Trading Strategy MACD Trading Example

Moving Average ConvergenceDivergence indicator (MACD

Moving Average ConvergenceDivergence indicator (MACD

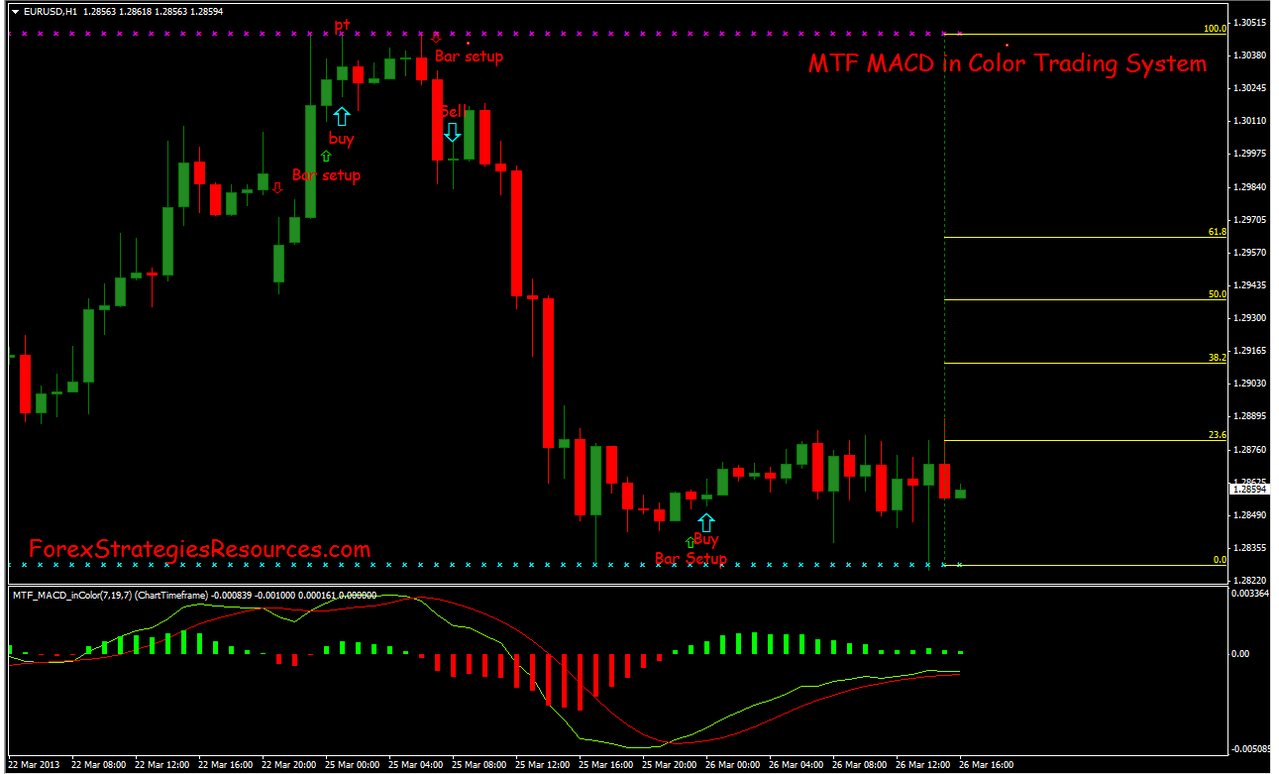

MTF MACD In color Trading System Forex Strategies

MTF MACD In color Trading System Forex Strategies

How to use MACD Indicator to Trade Stock & Binary Options

How to use MACD Indicator to Trade Stock & Binary Options

Comment utiliser le MACD en trading ?

Comment utiliser le MACD en trading ?

MACD Complete Guide on How to Use MACD in Trading

MACD Complete Guide on How to Use MACD in Trading

El indicador MACD Sistemas Inversores

El indicador MACD Sistemas Inversores

Trading MACD with Inside Bar Trading Setups Review

MACD Secrets That Can Help You Trade Like A Pro Bullbull

MACD Secrets That Can Help You Trade Like A Pro Bullbull

No comments: