Macd For Day Trading

The macd & rsi trading strategy is a straightforward system based on these indicators with the goal of identifying trends and opening scalping positions according to a trend direction. Macd(6,35,6) is more sensitive than macd(12,26,9) and can be a better macd setting for weekly charts.

A Simple Day Trading Strategy Using Bollinger & MACD

The simple answer is yes, the macd trading strategy can be used to day trade any security.

Macd for day trading. The macd breakout is used to confirm admiral pivot breakouts in the trend direction. Instead, to use it with other indicators. The macd stock indicator is based on whatever time frame you are trading.

It is designed to measure the characteristics of a trend. Using this with the ema of the macd itself(the signal line), and we have a dependable indicator. What is the best macd setting for day trading?

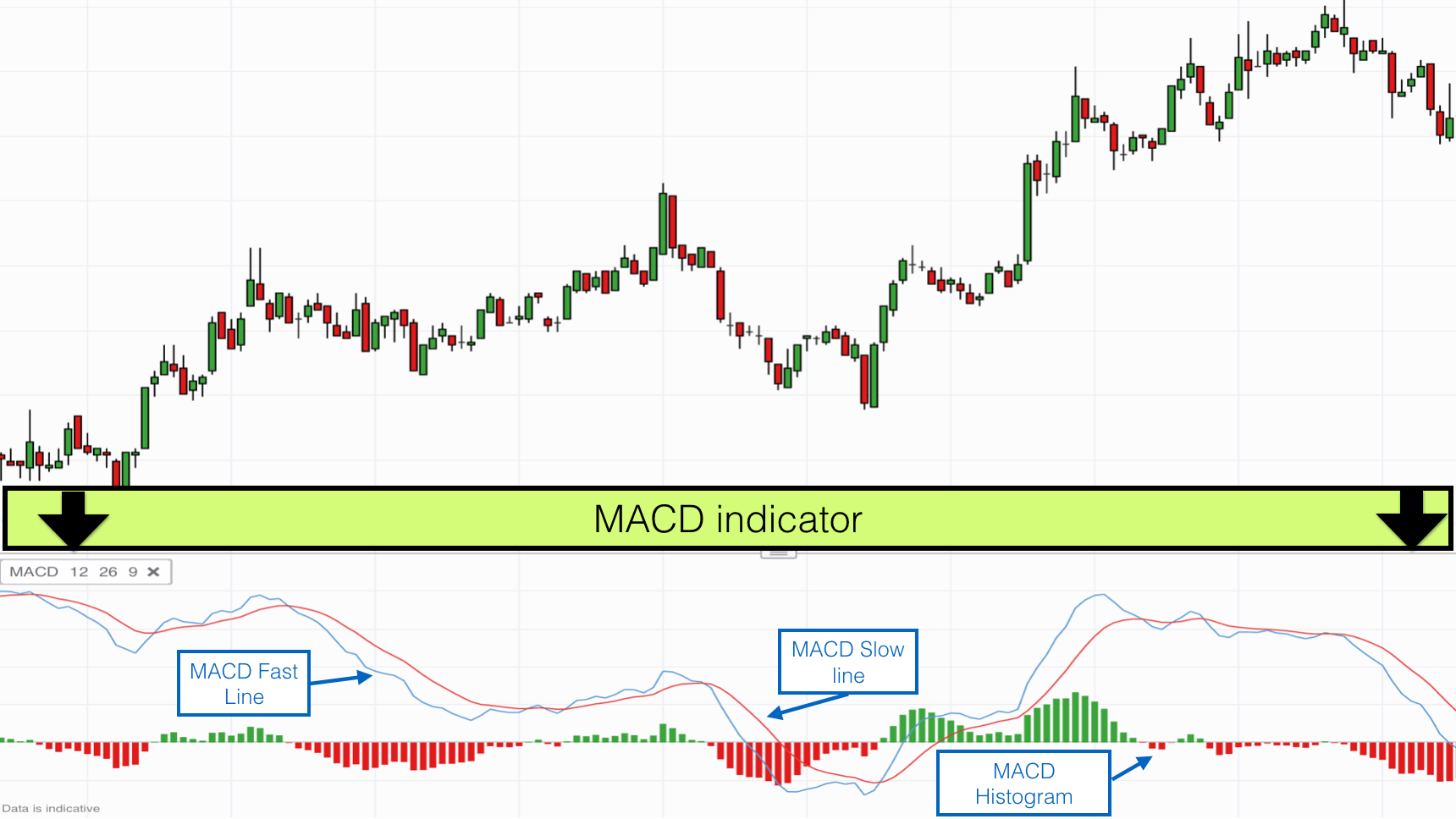

I went into detail on this blog post about the macd and in this strategy, it will act as an indication of trend direction/momentum direction. These better known as moving average convergence divergence. The moving average convergence divergence (macd) calculation is a lagging indicator used to follow trends.

However, you’ll never hear anybody actually say the full name of it. The macd ( moving average convergence divergence ) indicator is a technical analysis tool that was designed by gerald appel in the late 1970s. Macd macd uses the difference between two exponential moving averages to determine the direction of the trend and its momentum.

You’ll literally just say it macd. Traders will also use it to confirm a trade when combined with other strategies as well as a means to enter a trading. As mentioned earlier, exiting a trade properly is often the toughest part of trading well and the second macd can help with that.

For this breakout system, with the best macd settings for day trading, the macd can be used as a filter and as an exit confirmation. Greetings today i am going to show you how to use macd indicator effectively and the macd settings for day trading macd is ( moving average convergence and divergence ) and histogram to find uptrend and downtrends we can use the default settings now for day trading in macd indicator macd settings for day trading The macd is appreciated by traders the world over for.

The histogram is derived from the other two components of the macd and, thus, don’t add as much explanatory value to overall macd trading. In other terms, a macd line above the center line suggests a stronger upside momentum, while if it is below the central line it indicate a stronger downside trend. This is a simple day trading strategy using one hour charts, the macd and three exponential moving averages.

How accurate is macd divergence? The macd is part of the oscillator family of technical indicators. Users of the macd generally avoid trading in this situation or close positions to reduce volatility within the portfolio.

This day trading setup uses the macd indicator to identify the trend and the bollinger bands as a trade trigger. Moving average convergence divergence (macd) is one of the most commonly used techincal analysis indicators. Admiral pivot (d1) (requires mt4se) 50 exponential moving average (50 ema) 200 exponential moving average (200 ema)

Divergence between the macd and the price action is a stronger signal when it confirms the crossover signals. Besides, macd is no longer useful after a strong price rally. The second macd settings are 19,39,9.

Best macd settings for day trading effectively. Just like any other trading indicator, it is best not to use macd in isolation. This is because macd divergence when on its own, doesn't signal a reversal in price with the precision required for day trading.

Moving average convergence divergence (macd), invented in 1979 by gerald appel, is one of the most popular technical indicators in trading. In day trading, when traders use m5 or m15, or m30 chart time frames, the best performance is obtained using standard macd settings for day trading (12,26,9). During trading ranges the macd will whipsaw, with the fast line crossing back and forth across the signal line.

Therefore, it’s effectiveness or lack thereof is has nothing to do with intraday trading versus daily charts. Last updated on january 12th, 2021. This simple day trading strategy was published on tradingmarkets.com by markus heitkoetter, a day trading coach from rockwell trading.

It consists of two exponential moving averages and a histogram. We explore what the macd indicator looks like on an example chart and how you can read it to gain trading insight. Today’s quick day trading strategies lesson is an indicator called the macd’s.

It is used as a trend direction indicator as well as a measure of the momentum in the market. Our emas will act as a line in the sand, direction, as well as triggers into the trade once they set up. This strategy is in high demand among novice traders because the trader receives accurate signals together with a simple algorithm.

You can read all about its use and construction from how to use macd in day trading? This technical analysis guide explains what the moving average convergence divergence indicator (macd) is, and how traders use it to exercise trading strategies. Moving average convergence divergence (macd) indicator in forex explained 16 feb.

Day Trade Mini indice Setup MACD Dia 19/12/2016 Parte I

Day Trade Mini indice Setup MACD Dia 19/12/2016 Parte I

How To Use The MACD Indicator To Day Trade 2017 Stock

How To Use The MACD Indicator To Day Trade 2017 Stock

Day Trading Strategies Class Using MACD And Bollinger

Day Trading MACD Screener for Choppy Markets YouTube

Day Trading MACD Screener for Choppy Markets YouTube

How to use the MACD trading indicator

How to use the MACD trading indicator

Profit MACD strategies Forex Day Trading System Very

Profit MACD strategies Forex Day Trading System Very

Advance MACD strategies Forex Day Trading System Very

Advance MACD strategies Forex Day Trading System Very

HMABollinger Bands Day Trading System with RSIMACD Part

HMABollinger Bands Day Trading System with RSIMACD Part

BEST MACD SETTINGS FOR DAY TRADING 5 TIPS ActiveGainer

BEST MACD SETTINGS FOR DAY TRADING 5 TIPS ActiveGainer

Day Trading with MACD and Stochastic YouTube

Day Trading with MACD and Stochastic YouTube

Forex For Beginners What's MACD & How To Trade It

Forex For Beginners What's MACD & How To Trade It

Day Trading with 18 Moving Average Smoothed and MACD (With

Day Trading with 18 Moving Average Smoothed and MACD (With

A Simple Day Trading Strategy Using Bollinger & MACD

MACD Trading with 15 & 200 LWMA

MACD Trading with 15 & 200 LWMA

Day Trading with 18 Moving Average Smoothed and MACD

Day Trading with 18 Moving Average Smoothed and MACD

BEST MACD SETTINGS FOR DAY TRADING 5 TIPS ActiveGainer

BEST MACD SETTINGS FOR DAY TRADING 5 TIPS ActiveGainer

How To Read Macd Chart Day Trading Canada Software Liceo

Forex Trading Macd Forex Flex Ea Version 4.65

Forex Trading Macd Forex Flex Ea Version 4.65

No comments: