Oil Price Trading Economics

So, much lower price point in terms of existing wells versus new wells. This training course is designed to provide you with a complete understanding of the physical and financial markets for crude oil and petroleum products.

Brent Crude Oil oil prices are consolidating Oil prices

Brent Crude Oil oil prices are consolidating Oil prices

Tips on trading crude oil futures.

Oil price trading economics. Through this page of crude oil futures rate you may get the high, low, open, close and change. The extraction of oil and natural gas from shale has reduced the amount of oil the united states needs to import and is adding to the economy in the forms of jobs, investment, and growth. There is a differential in the price of a barrel of oil based on.

The new york mercantile exchange futures price for crude oil is reported in almost every major u.s. Crude oil futures decline on low demand | news. Crude oil prices are commonly measured in usd.

Demand is generally highest during the summer and winter months, but for different reasons. Updated 9:09 am cst, monday, january 4, 2021 Since the poll of 189 businesses was conducted before the latest round of duties on chinese goods threatened by u.s.

The iea expects crude oil consumption to be much lower in 2020. When the economics of oil prices don't add up. Growth driving growth in oil use, t hus crude oil price s increased dr amatically during 2007, with oil prices climbing from an average of nearly $55 per barrel in the first quarter of 2007 to.

Economies.com provides the crude oil price today. Brent crude oil is expected to trade at 60.53 usd/bbl by the end of this quarter, according to trading economics global macro models and analysts expectations. Looking forward, we estimate it to trade at 52.37 in 12 months time.

You may as well read news and analysis for trading crude oil by clicking on the tabs. The price of oil, or the oil price, generally refers to the spot price of a barrel of benchmark crude oil—a reference price for buyers and sellers of crude oil such as west texas intermediate (wti), brent crude, dubai crude, opec reference basket, tapis crude, bonny light, urals oil, isthmus and western canadian select (wcs). Recession ranked second and third in the global risk survey.

The slowdown in china and a u.s. It is geared towards all personnel in the petroleum or associated industries needing to improve their knowledge and understanding of crude oil and petroleum products. The differences between wti and brent include not only price but oil type as well, with wti producing crude oil with a different density and sulfur content.

Energy news covering oil, petroleum, natural gas and investment advice That’s the view of oxford economics, which found that the top risk is the trade dispute damping growth. The demand for crude oil is dependent on global economic conditions as well as market speculation.

Heating oil 1.6052 0.00 0.22% gold 1,856.27 15.91 0.86% silver 27.060 0.69. After the iranian revolution in the late 1970s, the price of oil rose sharply. Here’s taking the mystery out of crude oil pricing.

Oil prices are unlikely to soar much above the $60 per barrel mark, considering that this price level would incentivize a lot of oil supply, including from the united states, torbjörn törnqvist. Oil price charts for brent crude, wti & oil futures. Basic supply and demand theory states that the more a product is produced, the more cheaply it should sell, all things being equal.

By the second quarter of 2018 pump prices had risen to just under 125p per litre, reflecting higher global oil prices. Welcome to this online course on oil markets trading & economics framework. The oil is commonly wti.

Crude oil prices & gas price charts. Many unforeseen events can also impact the price of crude oil, either increasing or decreasing it. Rising fuel prices were largely responsible for upward pressure on the inflation rate in the second half of 2016.

Additionally, trading can be executed at an average differential to the previous day’s settlement prices for periods of two to 30 consecutive months in a single transaction. Crude oil is expected to trade at 57.23 usd/bbl by the end of this quarter, according to trading economics global macro models and analysts expectations. 16 feb, 2021, 04.43 pm.

West texas intermediate crude oil was trading 0.76 per cent higher at $59.92 per barrel, while brent crude oil was quoting 0.09 per cent down at $63.24 per barrel in new york. In this way, the nymex gives a forecast of what oil traders think the wti spot price will be in the future. Heating oil 1.7155 0.02 0.88% gold 1,814.36 22.10 1.23% silver 26.920 0.63.

(2011) and low (2020) of the past decade, crude oil prices are trading between the 23.6 % retracement (34.76. Looking forward, we estimate it to trade at 49.22 in 12 months time. When tracking price movement and making trades, remember that the price of unleaded gas and heating oil can influence the price of crude oil.

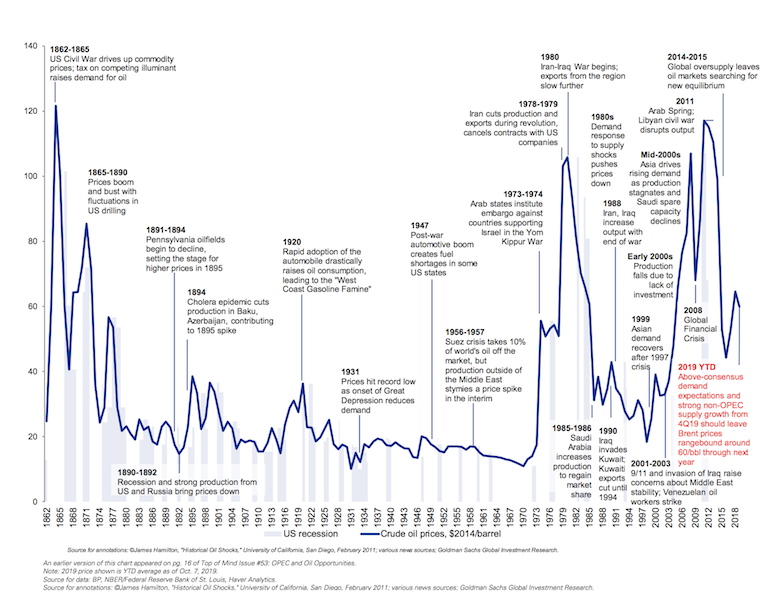

Collapsing Oil Prices, Not Trade, Pose Biggest Exogenous

Collapsing Oil Prices, Not Trade, Pose Biggest Exogenous

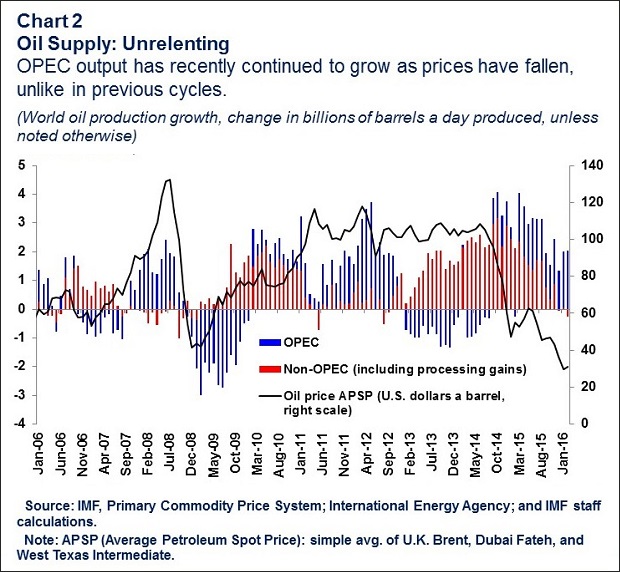

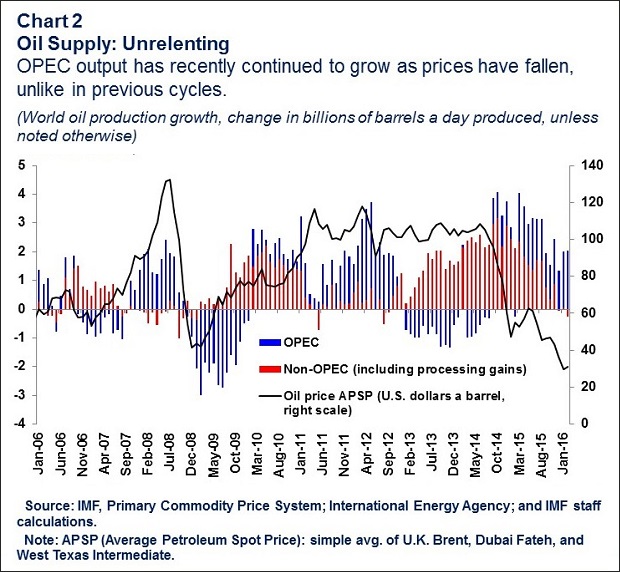

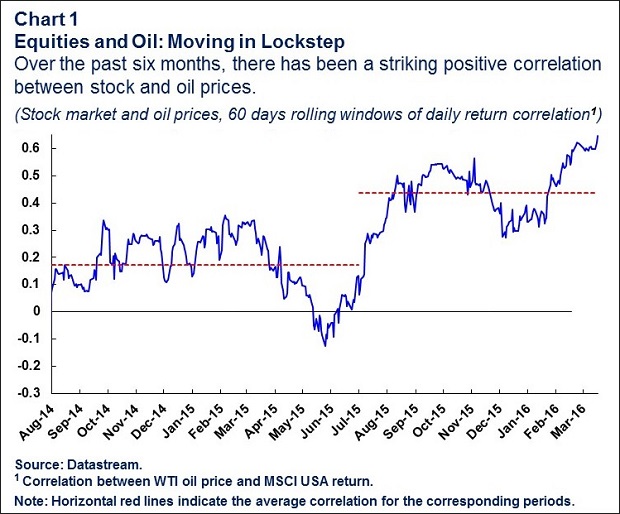

Oil prices and the global economy It’s complicated

Oil prices and the global economy It’s complicated

Oil prices and the global economy It’s complicated

Oil prices and the global economy It’s complicated

Why Oil Prices Fluctuate Infographic Economics lessons

Why Oil Prices Fluctuate Infographic Economics lessons

Could Rising Oil Prices Help The Economy? Theo Trade

Could Rising Oil Prices Help The Economy? Theo Trade

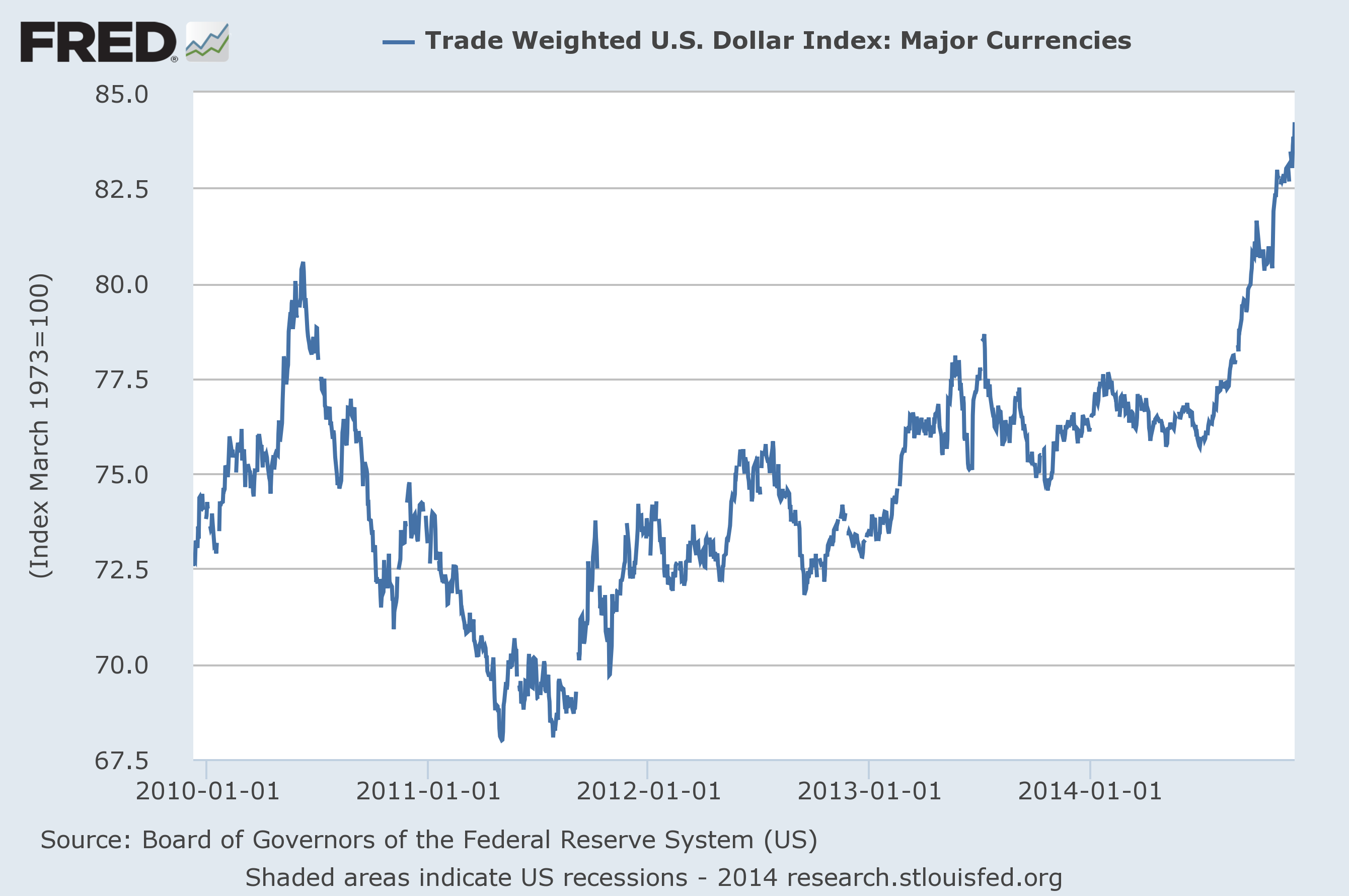

Oil Prices Have Shown A Solid Inverse Correlation With

Oil Prices Have Shown A Solid Inverse Correlation With

Crude oil posts longest losing streak in over 34 years

Crude oil posts longest losing streak in over 34 years

Effects of OPEC on the Oil Futures Market

Effects of OPEC on the Oil Futures Market

Can an Oil Shock Cause a Recession?

Can an Oil Shock Cause a Recession?

How Crude Oil Prices Impact Indian Market & Economy

How Crude Oil Prices Impact Indian Market & Economy

Atlanta Fed, Italy trade, mtg purchase apps, oil prices

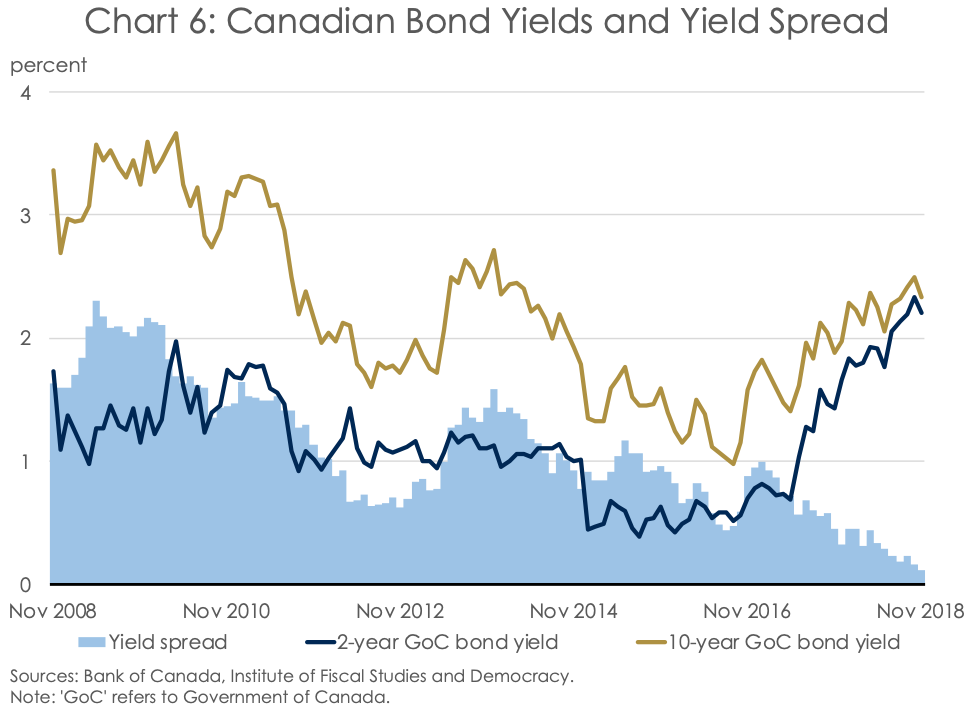

Canadian Economic Forecast Things to WatchOil Prices

Canadian Economic Forecast Things to WatchOil Prices

Canadian trade stuck in neutral BlackRock Blog

Canadian trade stuck in neutral BlackRock Blog

Oil prices as an indicator of global economic conditions

Oil prices as an indicator of global economic conditions

India cannot finance the oil it needs for its economic

India cannot finance the oil it needs for its economic

Why The United States Rule Oil Prices... Not OPEC (In 4

Canada’s 50 most important economic charts for 2016

Canada’s 50 most important economic charts for 2016

.png) Singapore nonoil exports tipped to expand 35 in 2020

Singapore nonoil exports tipped to expand 35 in 2020

No comments: