Ema Trading

Trading with the exponential moving average. What is ema in trading?

High Profits Advanced Forex Smoothed Moving Average (SMMA

High Profits Advanced Forex Smoothed Moving Average (SMMA

Ema is one of the oldest trading indicators and is used by thousands of traders today.

Ema trading. The exponential moving average ema strategy is a universal trading strategy that works in all markets. To better understand what ema is, we need to look at its foundation. A very popular way to use the 200 period moving average is with another smaller period moving average.

Ema trading or exponential moving average based trading is a strategy that involves using the exponential moving average indicator. To clarify, old data points retain a multiplier (albeit declining to almost nothing) even if they are outside of the selected data series length. Like all moving averages, this technical indicator is used to produce buy and sell signals.

For example, you can simple combine two periods of exponential moving averages on the charts. E.m.a trading is a global trading company specializing. Ema combines with heiken ashi candlestick chart.

The 50 ema bounce trading strategy also utilizes the hidden divergence. This is the most important principle when it comes to using any trading strategy successfully. The ema is a moving average that places a greater weight and significance on the most recent data points.

A common use is to use ema to identify the main trend and then wait for entry signals from the indicators or price behavior. If the stock does not close beyond the average. There are many ways to trade with the ema.

The exponential moving average (ema) is a lagging technical indicator and is a type of moving average that uses an arithmetic calculation to smooth out the price. Here are just a few ways you can trade with the indicator: For this ema trading strategy, the setup is much easier to happen.

What is exponential moving average (ema)? Crossover strategy tutorial & review updated: Sometimes, the ema will work.

And other times, none will work. But it has strict criteria whereby the market has to bounce off the 50 ema. 17 dec 2020 finding the right trading strategy that suits your style can be tough, but using an ema crossover strategy can be extremely effective in helping you to become a profitable technical analysis based trader.

What is exponential moving average. This causes this type of moving average to be more immediately sensitive to price fluctuations and therefore it will change direction more quickly. It is our proud privilege to be amongst the best.

This trading strategy relies heavily on catching the trend. While you can use the exponential moving average in many ways, professional traders stick to keeping things simple. The ema (5) and ema (20) crossover trading strategy.

The setup also works for any time frame. You may have success using this strategy on as low as the one hour chart or as high as the daily chart; If the exponential moving average strategy works on any type of market, they work for any time frame.

E.m.a trading is a global trading company specializing in supplying premium brands to b2b customers worldwide. The ema is a derivative of basic or simple moving average (sma). The most popular and widely used combination is the 200 and 50 moving average.

Ema is the name synonymous journey to the world with spices and herbs, fruits & vegetables, cereals & grains, coffee, & other organic ethiopian products to the world. An exponential moving average (ema) is very similar to (and is a type of) a weighted moving average. Ema 50 crosses ema 200 trading strategy.

Ema trend trading getting started. “in statistics, a moving average is a calculation to analyze data points by creating a series of averages of different subsets of the full data set.” The sma is calculated by taking the close, open, high, or low price of an asset within a certain period, adding them, and dividing it with the period.

The major difference with the ema is that old data points never leave the average. Sometimes, the sma will work. Thanks to our solid position in the market and many years of.

Using the ema should be used in conjunction with other trading. In supplying premium brands to b2b customers worldwide. And the beauty of this trading strategy is that there’s no need to identify candlestick patterns.

The exponential moving average is an average price calculation over a certain time period that applies more weight on the most current price data causing it to react faster to price change. Ema gives the meaning of exponential moving average, and this is one of the most commonly used forex trading strategies. The ema in forex trading is the same thing, except the formula is mathematically weighted to put more emphasis on the most recent candlesticks.

The strategy is simple, we take 2 exponential moving averages, one with a shorter period and the other with a longer period and we track the signals when a crossover occurs. Most amateur traders will go broke because they try to achieve a winrate of 90% or 95%. The ema can be a useful forex trading tool when considering entry and exit points and is one of the most popular trading indicators.

This means you can trade using this strategy on your preferred chart. There are no trading strategies that will generate a profit every single time, but there are some really basic strategies that can produce some pretty good results. Simple moving average (sma) this is a result of the this helps to determine entry and exit points of the trade base on the place of price action sit on the trading chart.

In order to consider options for additional testing and development of vaccines that are effective against new virus. There are many ways to use ema to find entry points in options trading. Ema construction and trading plc.

The heiken ashi candlestick chart is a reliable tool for trading following the trend. Amateur traders try to avoid losses at all. Our company was in import export business for the last seven years with our sister companies.

Download M30 EMA Trading System For Mt4 Forex Mt4 Indicators

Download M30 EMA Trading System For Mt4 Forex Mt4 Indicators

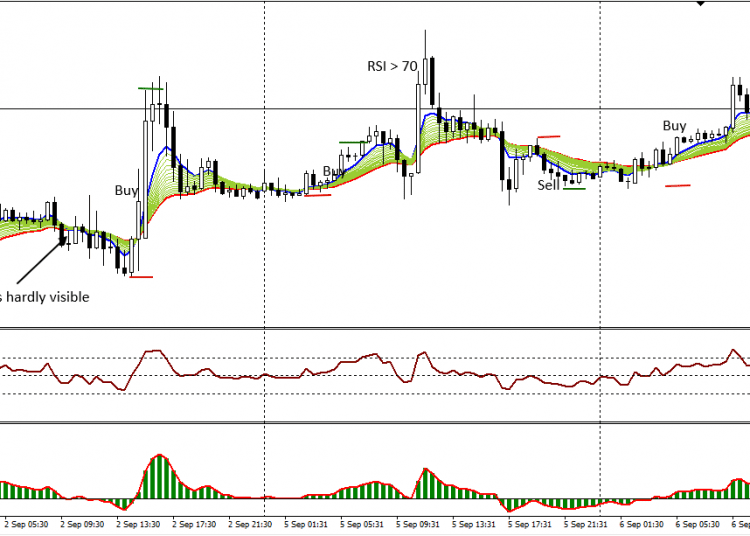

Forex Trading Strategy with EMA(5), EMA(12) and RSI(21

Forex Trading Strategy with EMA(5), EMA(12) and RSI(21

50 EMA Forex Trading StrategyThe Trading Rules Are Really

Support and Resistance support and resistance trading

Support and Resistance support and resistance trading

The "Double EMA" trading strategy

The "Double EMA" trading strategy

Forex 20 Ema Strategies Forex Early Warning Trading

3 EMA Forex Trading Strategy 〽️ YouTube

3 EMA Forex Trading Strategy 〽️ YouTube

30 min MACD Bounce EMA Trading System Forex trading

30 min MACD Bounce EMA Trading System Forex trading

EMA Trading System. This simple tutorial will illustrate

EMA Trading System. This simple tutorial will illustrate

EMA_Convergence — Indicator by repo32 — TradingView

EMA_Convergence — Indicator by repo32 — TradingView

EMA Trading Techniques Besttrading.eu

EMA TRADING STRATEGY TUTORIAL! 2020 YouTube

EMA TRADING STRATEGY TUTORIAL! 2020 YouTube

EMA Trading System Forex Winners Free DownloadForex

The 3 Step EMA Strategy for Forex Trends

Forex 4Hour Stochastic EMA Trend Trading Strategy

Forex 4Hour Stochastic EMA Trend Trading Strategy

Free Technical Analysis Software 20 Ema Trading Strategy

EMA Trading Strategy (That Actually Works!) YouTube

EMA Trading Strategy (That Actually Works!) YouTube

No comments: