Money Management Trading Forex

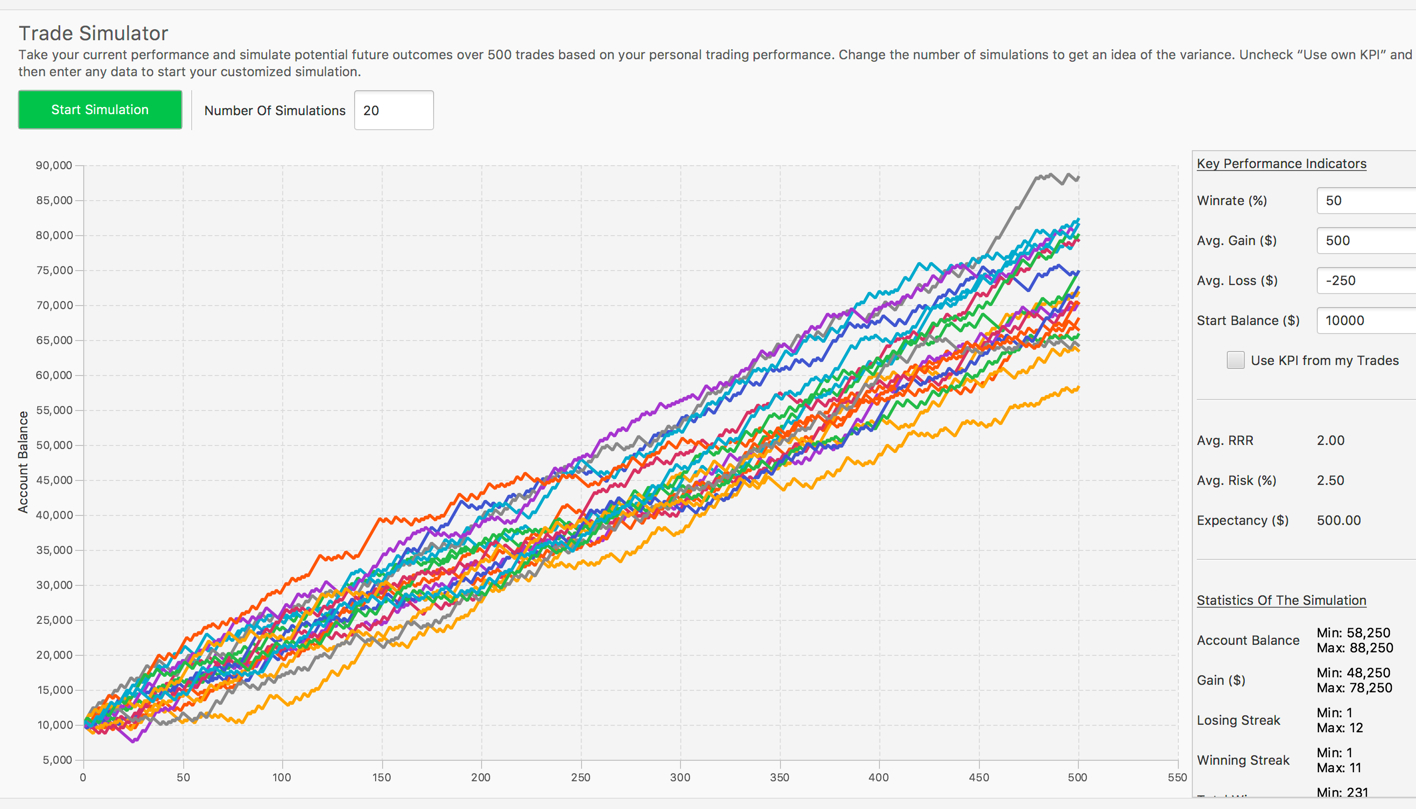

I am a systematic trader so i like trading statistics. The biggest problem for me was how i can differentiate between normal or big drawdawn and system stopped working scenario and finding the risk/trade so then i can survive bad periods.

Forex Trading Strategies Money Management by Pascal

Forex Trading Strategies Money Management by Pascal

Risiko di sini bisa diartikan risiko loss yang ingin diambil per trading.

Money management trading forex. I want to share my thoughts on money management. Literally in or out of own pockets. Whether you are a day trader, swing trader or a scalper, money management is an essential restraint that needs to be learned and implemented per trade opened, no matter your trading style or strategy.implement the money management techniques or you increase the risk of losing your money.

But unfortunately many traders ignore them due to a wide range of factors. Good money management is what dictates the profitability of a trader. Money management is the most significant aspect for traders in forex trading, representing the amount of money you will put on a trade and the risk you can accept for the trade.

Forex merupakan bisnis dengan nilai transaksi terbesar di dunia dan berjalan selama 24 jam selama 5 hari. It is varied as it is flexible, and you will eventually find one that suits you the most. What is money management in forex?

Karena dengan manajemen keuangan yang baik, maka seorang trader akan memiliki peluang lebih besar untuk memperoleh profit secara konsisten. Always use stop losses 3. Trade safe building stable gains.

Bentuk risiko yang sering dihadapi oleh para pebisnis adalah kerugian. Know your risk per trade 2. While it’s pretty easy to understand the benefits of these techniques, it happens that beginners to forex trading tend to neglect even basic money management rules and end up blowing their accounts.

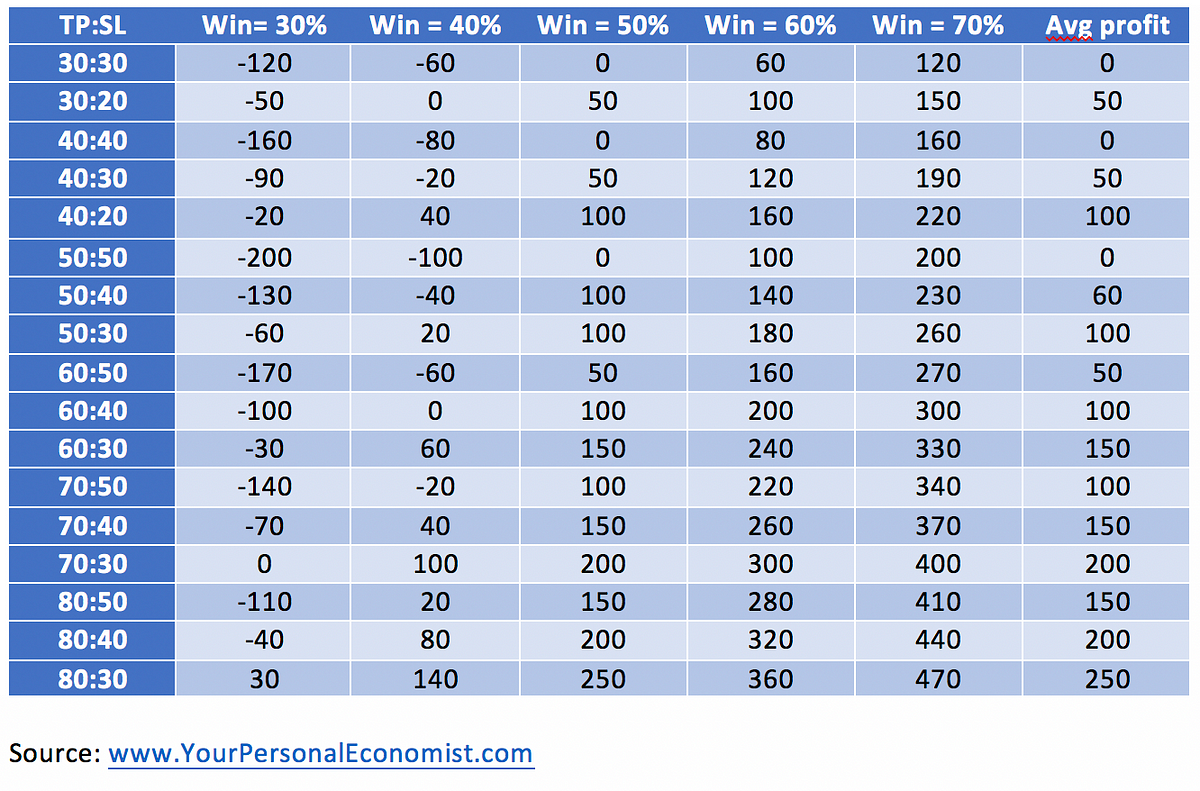

Why is forex money management so important. Money management forex refers to a set of rules that help you maximise your profits, minimise your losses and grow your trading account. Kita ambil contoh risiko 2% per trading.

A master of money management is a master forex trader. We have collected the list of 10 most efficient money management strategies that can help you become a successful forex trader. They blankly believe the forex broker is giving them money.

Don’t trade based on emotions 6. Novice traders are trading forex without any forex trading plan or money management technique. If you don’t believe in efficient money management, you may lost your capital (margin call) in a few days or even few minutes.

The thinking goes that if they can just find the latest and greatest system all their dreams will come true and the millions will come rolling in. Yet most people don’t spend nearly enough time concentrating on developing or implementing a money management plan. Februari 10, 2021 14 views.

The key to success behind a successful trader is his strong and disciplined money management. Money management that actually works in forex! Money management tips with avatrade.

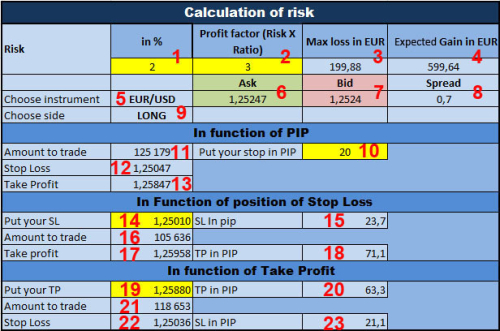

The paradox of this is that until you develop your money management skills and consistently utilize them on every single. Forex risk management is one of the most, if not the most, important topics when it comes to trading. A professional trader that respects his money management rules will be profitable even with a mediocre trading strategy, while even the “holy grail” won’t help an amateur trader who doesn’t follow the basic rules of money.

Money management in trading currencies should be a key part of a forex trader’s overall risk management strategy. Tidak jauh berbeda dengan bisnis lain yang sedang anda jalani, dalam trading pun risiko akan tetap ada. When people first come to trading and in particular forex the first thing they look to do is find the shiniest and fanciest trading system they can get their hands on.

While money management in personal finances is the way you distribute your net income, money management in forex trading has more to do with your risk and the way you manage risk, the only thing they have in common is that each has the basic rules and tools. Apa hubungan antara risk dan money management dalam trading forex? Risiko adalah faktor penyerta dari setiap bisnis yang akan selalu dihadapi.

It is very vital for security trading, forex, options, futures and commodity trading. Hal yang perlu di ingat untuk setiap trader bahwa sehebat apapun. Bagaimana meminimalisasi risiko dan belajar money management forex dalam trading forex sehingga nilai investasi bisa bertumbuh?

How you are going to implement it into your trading strategy is another story. Money management is a way forex traders control their money flow: If you are perfect in forex trading so its means you can get a lot money and buy any thing with just forex trading.my this dream trading setup money management forex professional trading strategy will help you earn many dollar in trading business.mostly big trader use this indicator for just japan market session but i prefer you for uk session more accurate if i compare other market time.

Follow these 5 tips for effective money management in the forex market. Le trading avec money management est donc un facteur de succès non négociable pour les traders forex débutants et des traders expérimentés également. The core goal of successful money management is maximizing every winning trades and minimizing losses.

Money management forex adalah salah satu faktor penting dalam keberhasilan trading. Don’t overthink after you entered into the trade. Metode money management apapun pada dasarnya berakar pada pertanyaan mengenai berapa besar dana yang berani anda risikokan.

Yes, it's simply the knowledge and skills on managing own forex account. Money management is perhaps the most important technique traders need to understand when trading the forex market. Sebenernya bisnis forex ini sangat membutuhkan pengaturan modal atau money management yang sangat bagus.

Everybody knows how vital it is to implement risk management strategies when day trading. On the one hand, traders want to keep any potential losses as small as possible, but, on the other hand, traders also want to squeeze as much potential profit as they can out of each trade. As the name implies, forex money management involves consistently using one or more strategic techniques to make a currency trader’s risk capital yield the highest return for any losses that might be incurred in the process.

Forex / Compound Money Management EA Trade panel LIVE

Forex / Compound Money Management EA Trade panel LIVE

Money Management Share Trading Position Sizing Risk

Forex Risk Management Spreadsheet Spreadsheet Downloa

Money Management in Forex Equidious Research Best Forex

Money Management in Forex Equidious Research Best Forex

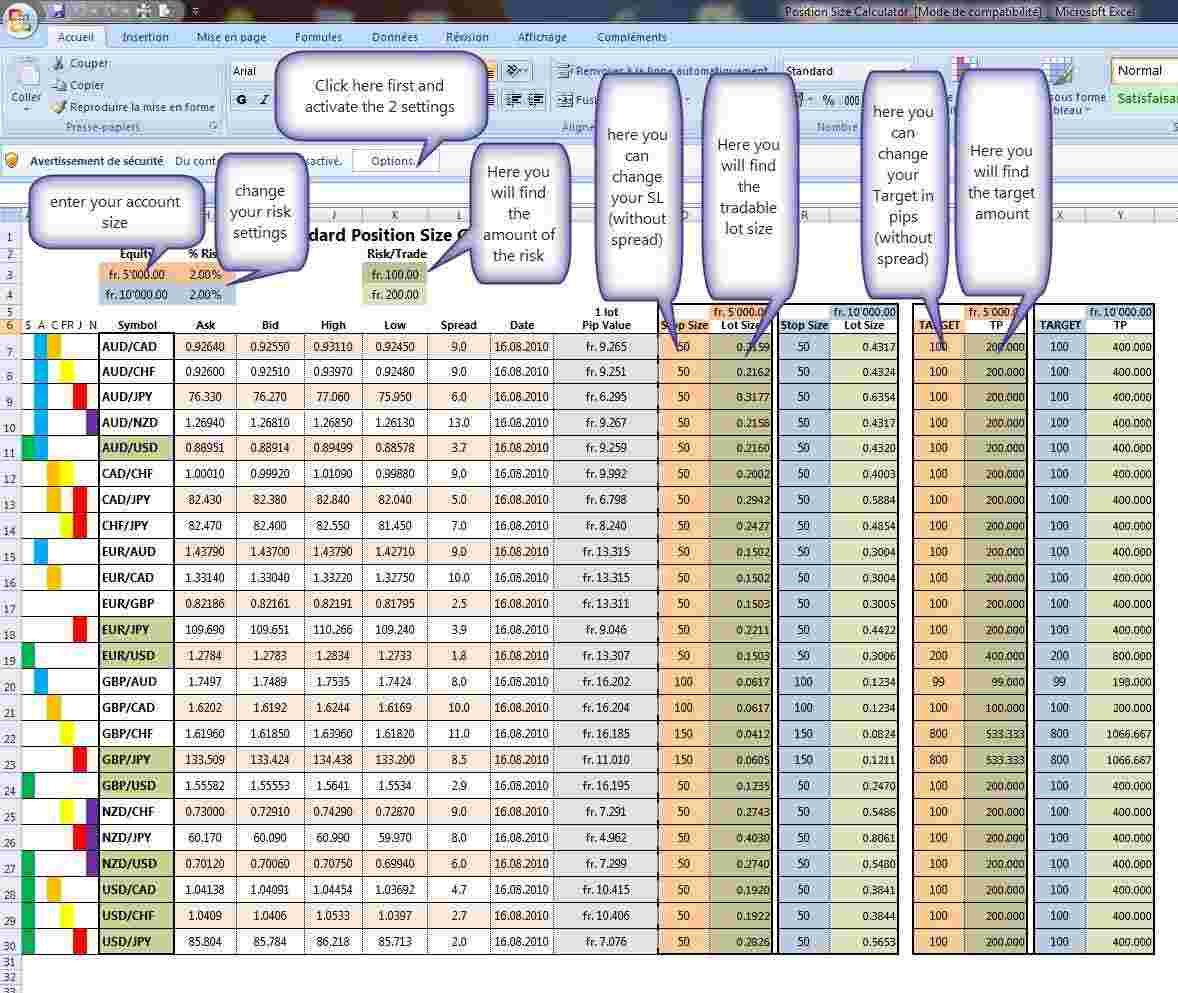

Money Management Forex Excel « Ladda ner binär alternativ

Forex Money Management Simple Forex Trading Money

Forex Money Management Simple Forex Trading Money

Forex Trading Money Management Best Forex Trading System

Forex Trading Money Management Best Forex Trading System

Money Management in Forex More Than Just Trading

Money Management in Forex More Than Just Trading

Money management plan Your way to the millions Forex

Forex Money Management Examples « 10 Best Binary Brokers

Money Management Calculator Forex Winners Free Download

Money Management Calculator Forex Winners Free Download

Forex Trading Journal Spreadsheet in Money Management

Forex Trading Journal Spreadsheet in Money Management

Forex Money Management Spreadsheet YouTube

Contoh Money Management (MM) Yang Baik Artikel Forex

Contoh Money Management (MM) Yang Baik Artikel Forex

Money Management with Microsoft Excel Part Ii Concours

Money Management with Microsoft Excel Part Ii Concours

Forex Risk Reward Ratio Quantina Forex News Trader Ea V4.51

Forex Risk Reward Ratio Quantina Forex News Trader Ea V4.51

Money Management Tips To Improve Your Trading Stacey

Money Management Tips To Improve Your Trading Stacey

Forex Money Management Spreadsheet Spreadsheet Downloa

Forex Money Management Spreadsheet Spreadsheet Downloa

Money management to trade forex. Get the free download

Money management to trade forex. Get the free download

No comments: