Binomial Trading

The binomial option pricing model excel is available as a template with marketxls.the binomial option pricing model is a popular model for stock options evaluation, and to calculate the options premium. Binomial model option pricing generates a pricing tree in which every node represents the price of the underlying financial instrument at a given point in time.

Binomo is a trading platform on which you can earn on rises or falls in currency exchange rates, stock prices and indices, commodities, and other assets.

Binomial trading. $1000 in a demo account for training and minimum trade amount is only $1. The tree would represent the possible prices. Binomo trading is duly authorised to operate under the exness brand and trademarks.

The first step is the creation of what's known as a price tree, which contains a number of specific time points starting with the point of. Pada semua perangkat, saat ini para pengembang telah memberikan kesempatan pada pengguna untuk membuka. Binomo is a modern trading platform for both — beginners and professionals.

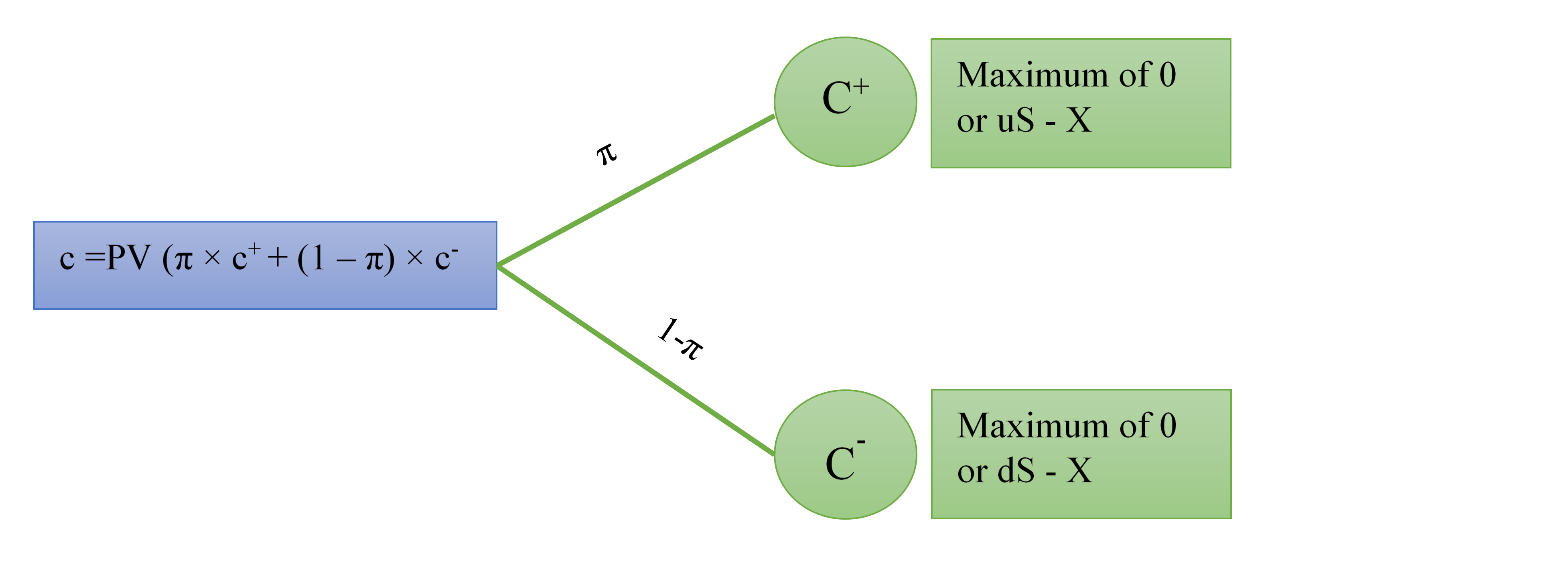

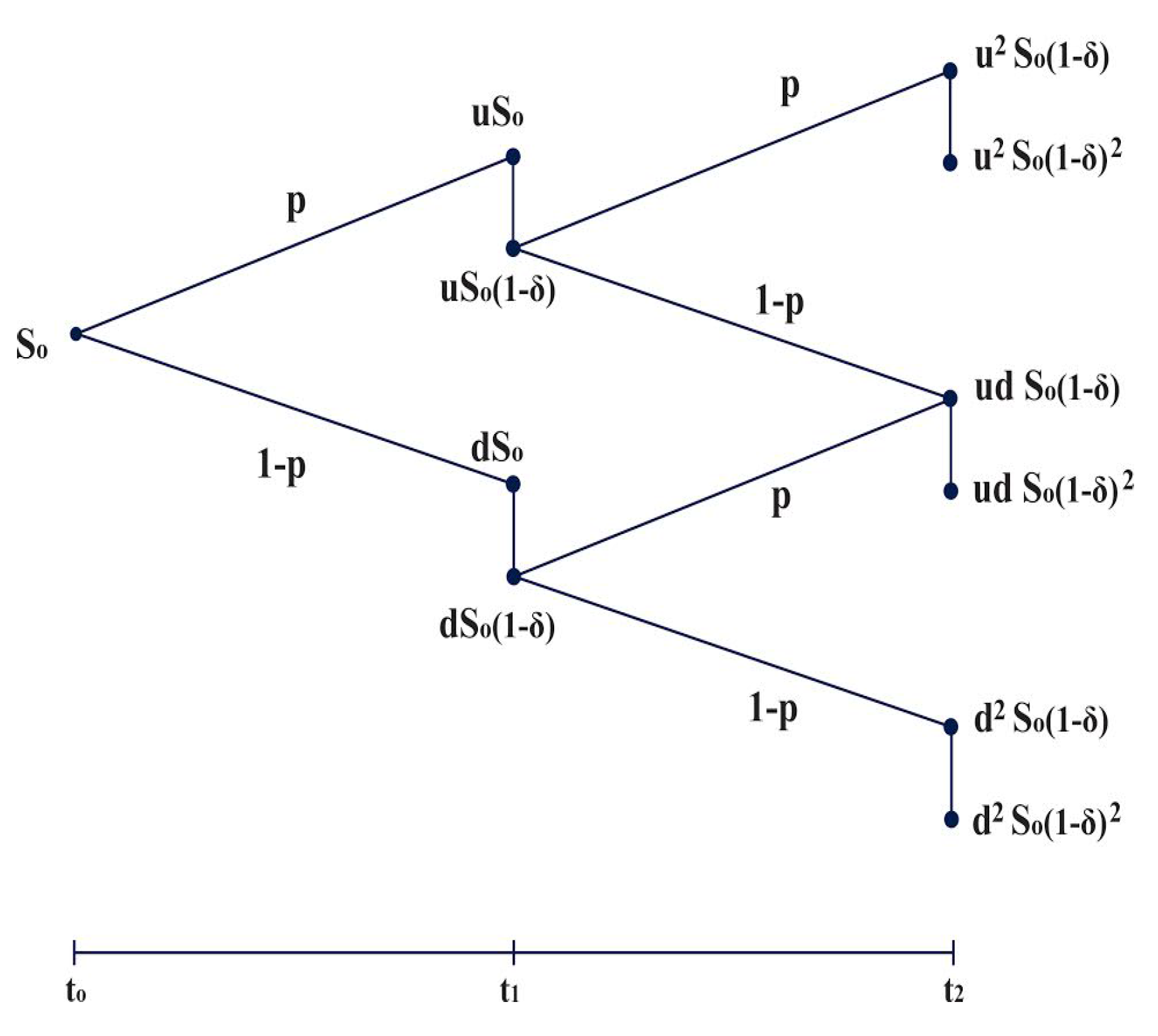

At each stage, the stock price moves up by a factor u or down by a factor d. The bopm, unlike the bs model typically used for european style options, allows you to price options which have the. The model provides a calculation of what the price of an option could be worth today.

What is the 'binomial option pricing model' the binomial option pricing model is an options valuation method developed in 1979. Trading menggunakan smartphone, dapat membantu anda mengakses pasar secara mobile, artinya dimanapun anda berada, selama terhubung dengan jaringan internet, maka anda juga dapat terhubung dengan pasar dan melakukan transaksi perdagangan. The binomial model is a mathematical method for the pricing of american style option contracts (option contracts that have a european exercise style will generally be priced using the black scholes model).a binomial method for pricing derivatives was first suggested by william sharpe in 1978, however, during 1979 three academics formalized a framework for pricing options.

Price movements of the underlying stocks provide insight into the values of options. You can use this pricing tree to price options with nonstandard features such as path dependence, lookback, and barrier events. It is a popular tool for stock options evaluation, and investors use the model to evaluate the right to buy or sell at specific prices over time.

Cox, ross and rubinstein have proposed the binomial model in 1979. There are three steps involved. A binomial option pricing model is an option pricing model that calculates an option's price using binomial trees.

A binomial option pricing model is an options valuation method that uses an iterative procedure and allows for the node specification in a set period. In the trading of assets, an investor can take two types of positions: This model is developed on the concept of decision tree model of statistics.

An investor can either buy an asset (going long), or sell it (going short). For this model application the binomial tree needs to be developed. The binomial option pricing model is useful for traders to help estimate the theoretical values of options.

The binomial option pricing model uses an iterative procedure, allowing for the specification of nodes, or points in time, during the time span between the valuation date and the option's expiration date.the model reduces possibilities of price changes, and removes. Learn conveniently and invest wisely! It is a popular tool for stock options evaluation, and investors use the.

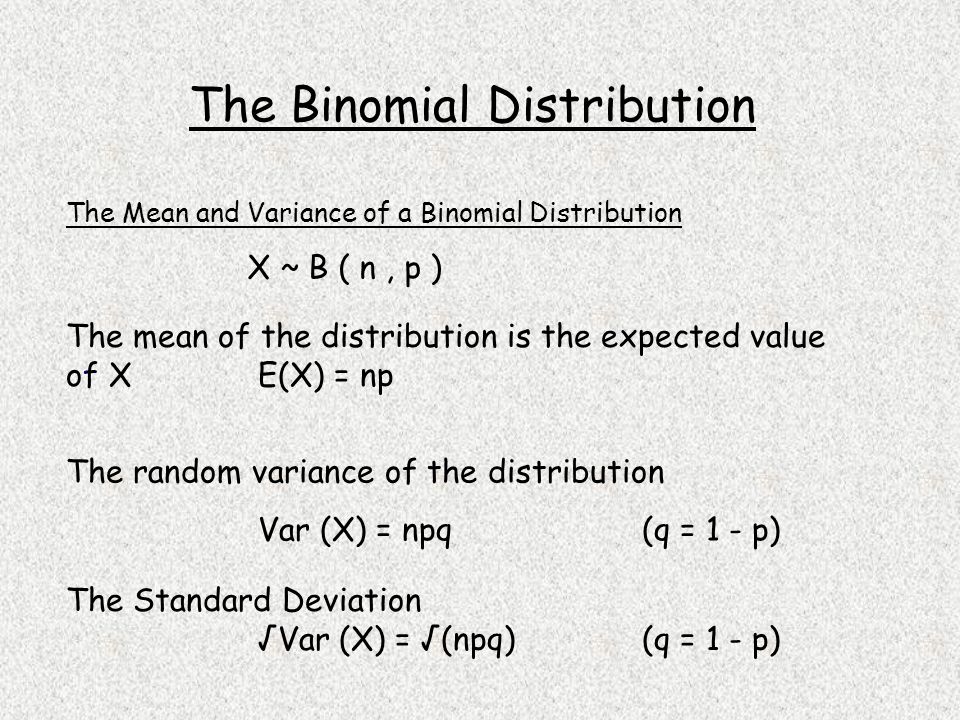

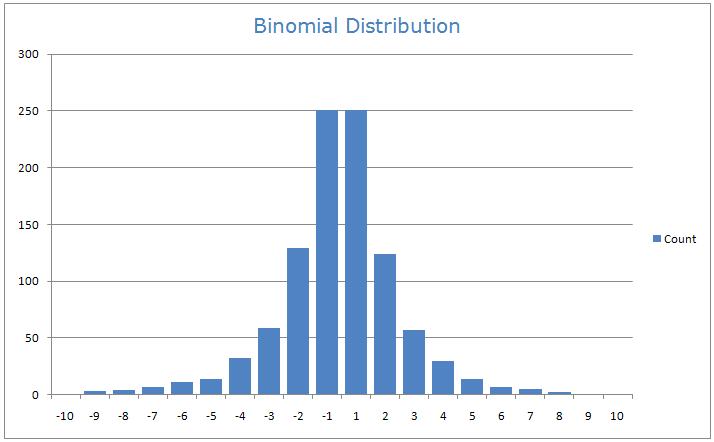

The binomial model, however, calculates how the theoretical value of an option will change as time moves on and the price of the underlying security moves up or down. The binomial distribution is a probability distribution that summarizes the likelihood that a value will take one of two independent values. Binomial option pricing model | forex trading.

Trading multiples trading multiples trading multiples are a type of financial metrics used in the valuation of a company. Binomial — check out the trading ideas, strategies, opinions, analytics at absolutely no cost! In this figure, s is the current stock price;

The registered office of binomo trading is at. We designed the platform and are constantly expanding its capabilities to make trading a pleasant and profitable experience, regardless of the user’s level of training.

6 3 Day 1 Binomial Theorem notes YouTube

6 3 Day 1 Binomial Theorem notes YouTube

Options Pricing Models Binomial (Two & MultiPeriod

Options Pricing Models Binomial (Two & MultiPeriod

Understanding Binomial Probability Distribution India

Understanding Binomial Probability Distribution India

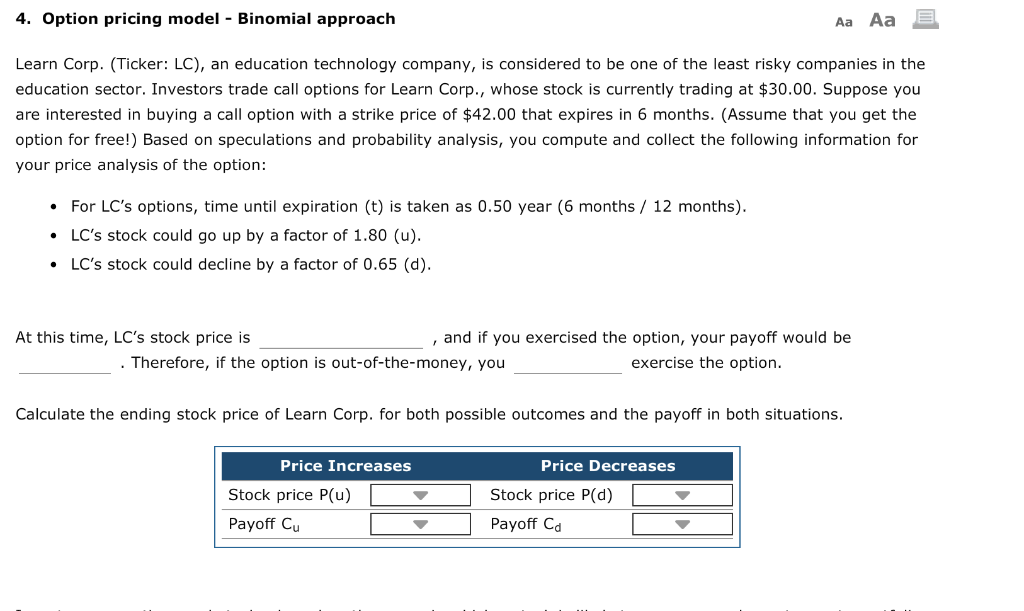

Solved 4. Option Pricing Model Binomial Approach Aa Aa

Solved 4. Option Pricing Model Binomial Approach Aa Aa

Trading Cards FOIL and Factoring Trinomials ax^2+bx+c

Trading Cards FOIL and Factoring Trinomials ax^2+bx+c

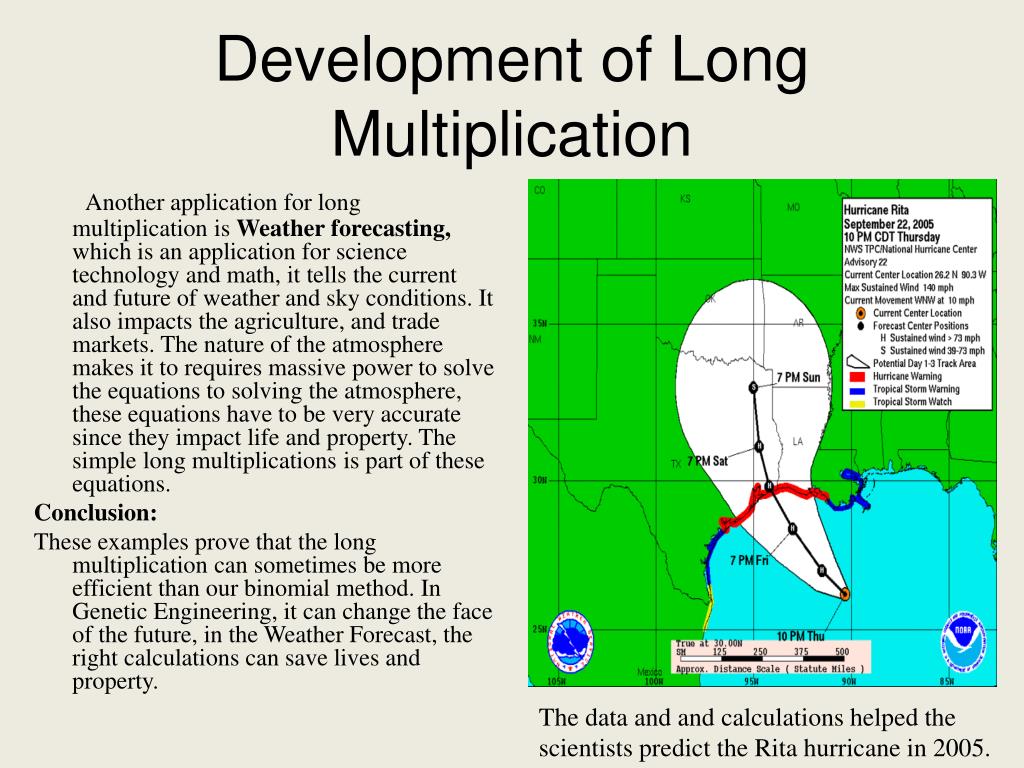

PPT Binomial Option Pricing Model PowerPoint

PPT Binomial Option Pricing Model PowerPoint

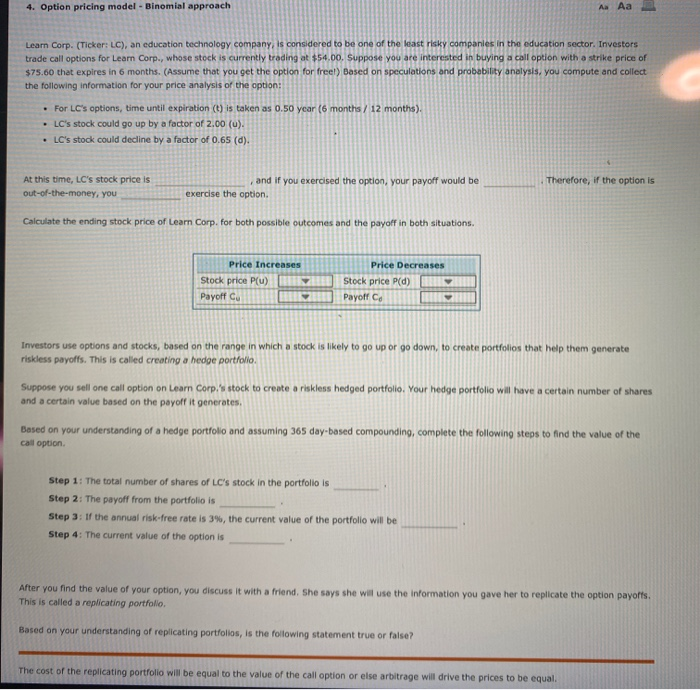

Solved 4. Option Pricing Model Binomial Approach Learn

Solved 4. Option Pricing Model Binomial Approach Learn

Binomial tree call option pricing forex hedge trade

PPT Binomial ExpansionsMath Reflection PowerPoint

PPT Binomial ExpansionsMath Reflection PowerPoint

Value american put option binomial variance * wigynyqiqih

35 Option Payoff Diagram Calculator Wiring Diagram Database

35 Option Payoff Diagram Calculator Wiring Diagram Database

X is a binomial variable such as that 2P(X=2) = P(X=3) and

Finite difference binary option vba INVESTED iQ

Binomial Model and it's Application to American Style

Binomial Model and it's Application to American Style

Trading Cards Factoring a Perfect Square T or Finding the

Trading Cards Factoring a Perfect Square T or Finding the

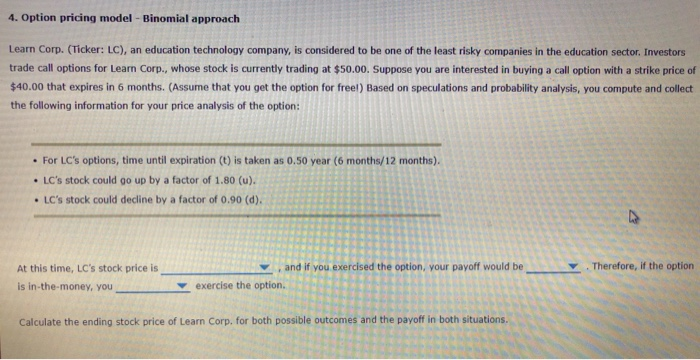

4. Option Pricing Model. Binomial Approach Aaa Lea

4. Option Pricing Model. Binomial Approach Aaa Lea

Lookback option binomial tree example who trades vix futures

JRFM Free FullText Pricing a Collateralized

JRFM Free FullText Pricing a Collateralized

binomial option greeks Excel in CFA

No comments: